Investing in foreign real estate is far more than a simple diversification play. It’s a strategic move into high-growth markets and a powerful hedge against economic volatility in your home country.

For savvy investors, real estate agents, and property owners aiming to attract overseas buyers, mastering the global property landscape is the first step. It opens the door to capitalising on international opportunities, from prime city apartments in established European hubs to high-yield ventures in emerging South American hotspots.

Why Global Real Estate Should Be on Your Radar

Dipping your toe into international property markets unlocks a world of potential far beyond the limits of a single economy. It’s a calculated move to secure assets in regions with entirely different economic cycles, demographic trends, and growth patterns.

Whether you’re a US-based investor eyeing a foothold in Europe or a European agent expanding into South American hotspots, the fundamentals of successful investing in foreign real estate don’t change. It all comes down to meticulous research, smart planning, and a firm grasp of cross-border complexities.

Think of this guide as your high-level briefing—the essential knowledge you need to navigate this rewarding asset class.

The Appeal of Established Markets

Mature, stable markets like the United Kingdom have long been a top destination for foreign capital, especially from North America. The appeal is obvious: political stability, transparent legal systems, and deep, liquid markets. These are the places you look to for long-term investment, where capital preservation is just as important as growth.

The numbers tell the story. A recent analysis revealed that between January and June, overseas buyers poured a staggering £12.2 billion into UK commercial real estate.

“That figure represents about 64% of the total £19.1 billion invested in the UK during that period. North American investors were the driving force, accounting for roughly £8.0 billion of that foreign spend,” according to a recent Financial Times report.

This isn’t just a fleeting trend. You can get the full picture on how cross-border capital has intensified in the UK property market in the full CoStar report.

Uncovering Emerging Hotspots

Beyond the traditional powerhouses, sharp investors are turning their attention to emerging markets. Countries in South America, like Colombia and Brazil, are gaining serious traction thanks to favourable demographics, a growing middle class, and improving infrastructure. These markets present a chance for higher capital growth, but they demand a much more rigorous approach to due diligence.

Closer to home for European investors, nations like Portugal and certain Eastern European countries offer compelling value, often sweetened with attractive residency-by-investment programmes. Knowing how to buy real estate in a foreign country involves understanding these unique local incentives.

A Mindset for International Success

Ultimately, success in investing in foreign real estate boils down to adopting a global mindset. You need an appreciation for cultural nuances, a willingness to get comfortable with unfamiliar legal frameworks, and the foresight to manage currency fluctuations.

The rewards—from robust rental yields to significant asset growth—are substantial for those who approach the market with diligence and strategic insight.

To get a feel for the opportunities out there right now, explore our listings of International Property For Sale.

Pinpointing Your Next International Property Hotspot

The success of your venture into investing in foreign real estate boils down to one thing: the quality of your homework. It’s easy to get swept up by glossy brochures and sun-drenched Instagram posts, but a disciplined, data-driven approach is what separates a landmark acquisition from a costly mistake. Finding a genuine hotspot requires a blend of top-down economic analysis and boots-on-the-ground intelligence.

First things first, you need to scrutinise the big picture. Key macroeconomic indicators give you a quick health check on a country’s future. Look for consistent GDP growth, a stable political climate, and serious government investment in infrastructure. These are the foundations of any solid property market.

When you see a country building new airports, high-speed rail lines, or upgrading its digital networks, that’s a massive signal. It shows they’re betting on their own future—a very good sign for any long-term investor.

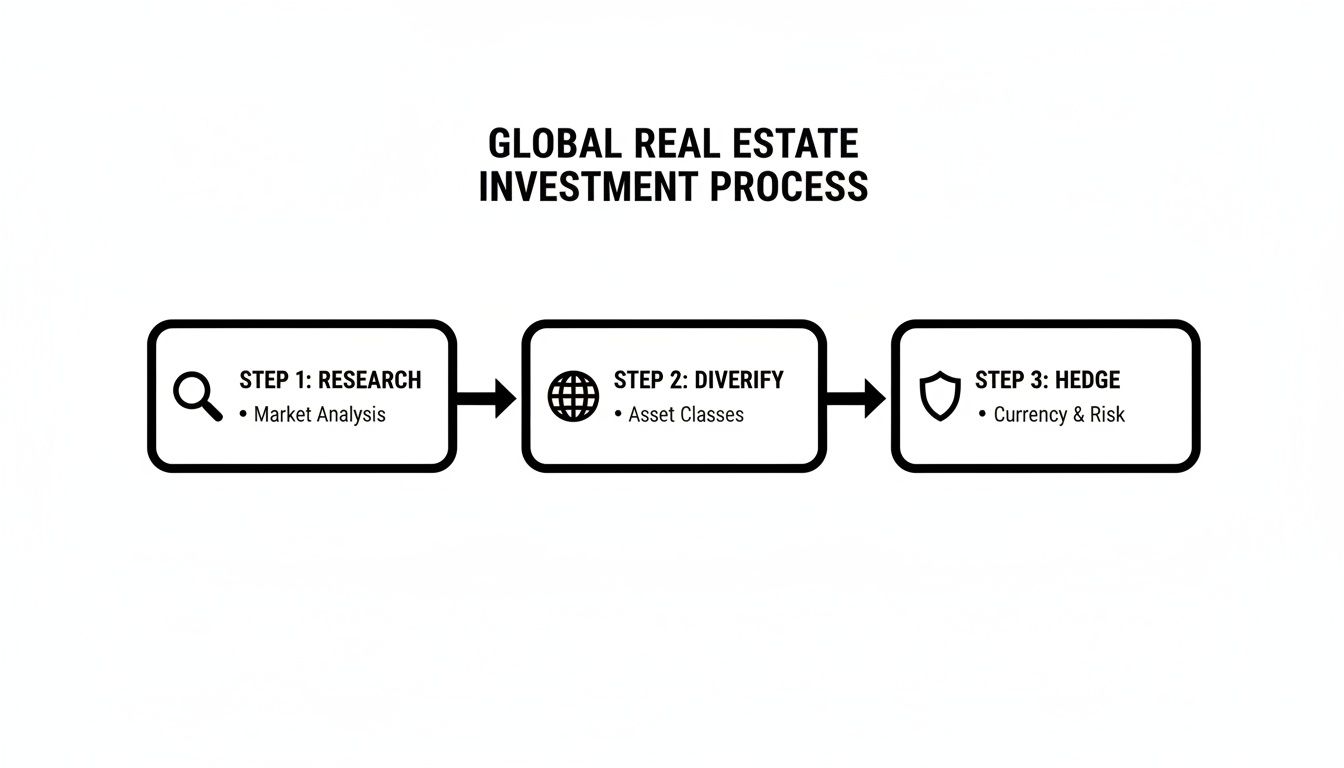

This chart breaks down the core strategic flow for sizing up global real estate opportunities.

As you can see, it all starts with deep research. From there, it’s about smart diversification and hedging your risks, which are absolutely crucial when you’re navigating overseas property ventures.

Differentiating Prime From Promising

The global market is a massive spectrum of opportunities, from established, blue-chip locations to up-and-coming hotspots. Each comes with a very different risk-reward profile, so you need to know what you’re getting into.

- Established Prime Markets: Think London, Marbella, or the best arrondissements in Paris. These markets offer stability, are easy to sell in (high liquidity), and have a proven track record. The chance for explosive growth might be lower, but they’re a reliable place to park your wealth. The UK market, for example, is still a magnet for foreign capital because of its strong performance in certain sectors.

- Emerging Hotspots: Places in Portugal, Colombia, or parts of Eastern Europe are really catching the eye of switched-on investors right now. These markets often have lower entry prices, the potential for much higher rental yields, and the possibility of serious capital growth as they mature. The trade-off? They demand much more thorough due diligence to navigate potential political or economic wobbles.

“Nick Marr says the real value is found by spotting growth trends just before they hit the mainstream. This means looking at rental demand, demographic shifts, and new business investment, not just past property price performance.”

— Nick Marr, founder of Homesgofast.com and EuropeanProperty.com

Gathering Reliable Intelligence

High-quality data is your best friend in this game. You need credible sources. The OECD is fantastic for economic data, while real estate consultancies like Knight Frank offer brilliant market-specific reports. These are non-negotiable tools. For a closer look at specific niches, check out guides on the best places to buy vacation rental property to see how the pros analyse micro-locations.

Even in stable markets, performance can be tricky. Take the UK real estate market. It delivered a solid total return of 8.1% over the 12 months to February, even while transaction volumes dropped by a massive 33% year-on-year in early 2025. This split—with strong returns in sectors like retail (11.3%) and build-to-rent—shows exactly why foreign money keeps flowing into specific UK subsectors.

Before you invest, it’s vital to run the numbers and understand the local context. A proper due diligence checklist helps you compare apples with apples across different countries.

Key Due diligence Metrics for Foreign Real Estate Markets

| Metric Category | Key Indicators to Analyse | Data Sources |

|---|---|---|

| Economic Stability | GDP Growth Rate, Inflation Trends, Unemployment Rate, Political Stability Index | World Bank, IMF, OECD, National Statistics Offices |

| Property Market Health | Average Price per Square Metre, Rental Yields (Gross & Net), Vacancy Rates, Property Price Index | Local Real Estate Portals (e.g., Zillow, Rightmove), Global Property Guide, Real Estate Consultancies (Knight Frank, Savills) |

| Legal & Regulatory | Foreign Ownership Restrictions, Property Taxes (Purchase, Annual, Capital Gains), Residency/Visa Rules | Government Investment Agencies, Local Real Estate Lawyers, Expat Forums |

| Local Demographics | Population Growth, Tourism Numbers (for rental markets), Expat Community Size, Infrastructure Projects | National Tourism Boards, City Development Plans, Worldometer |

This table isn’t exhaustive, but it’s the bare minimum you should be looking at to make an informed decision and avoid any nasty surprises down the line.

The Final Filter: On-the-Ground Due Diligence

Ultimately, no amount of Googling can replace seeing a place for yourself. Visiting your shortlisted markets is an absolutely crucial step. Walk the neighbourhoods. Talk to local estate agents. Get a feel for the vibe and the local economy. This is where you either confirm your research or uncover the deal-breakers that data alone just can’t reveal.

Building a shortlist is all about elimination. Start wide with economic filters, narrow it down with property market data, and then apply that final, all-important reality check on the ground. For more ideas on where to even begin your search, our guide on the best countries to buy property is a great starting point.

This methodical approach ensures your money goes not just into an appealing location, but into a market with real, sustainable growth potential.

Securing Finance and Managing Currency Risk

Once you’ve zeroed in on a promising market, the next big hurdle is structuring the finance. Let’s be clear: financing an overseas property is a different beast entirely from getting a domestic mortgage. Getting it right can seriously boost your returns, but a misstep can inject a world of unnecessary risk into your strategy for investing in foreign real estate.

Your financial game plan really comes down to two things: getting the capital to actually buy the place and managing the currency risk that comes with owning assets in another country’s money.

Navigating International Mortgage Options

For most investors, getting a mortgage in the country you’re buying in is the most straightforward path. But don’t expect it to be easy. Foreign lenders are notoriously cautious with non-resident buyers. That means you should brace yourself for tougher documentation requirements and lower Loan-to-Value (LTV) ratios than you’re used to back home.

Lenders will want to see everything—your global income, credit history, and exactly where your deposit came from. Putting together a bulletproof financial dossier isn’t just a good idea, it’s essential. This usually includes:

- Proof of Income: Get your tax returns, employment contracts, and statements from any other investments ready.

- Credit History: Your home country credit score doesn’t travel, but lenders will demand solid proof of a clean credit record.

- Source of Funds: You’ll need to show a clear paper trail for your deposit to satisfy strict anti-money laundering rules.

In my experience, you should expect LTVs for non-residents to be around 50-70%. This means you’ll need a much bigger cash deposit than you might think. For a detailed breakdown of what to expect, our guide covers the minimum deposits for overseas mortgages in the most popular destinations.

Another route is to use assets you already own at home. You could refinance a property or open a line of credit to fund a cash purchase abroad. This makes the buying process a lot simpler and turns you into a very attractive cash buyer, but remember, it also ties the new debt to your domestic finances.

Securing finance is often the biggest hurdle for international buyers. Lenders in popular markets like Spain or Portugal are experienced with foreign applicants, but they will always prioritise well-documented, financially sound individuals. Being over-prepared is a significant advantage.

Proactive Currency Risk Management

Here’s something too many investors overlook: currency risk. The constant ebb and flow of exchange rates can have a massive impact on your purchase price, your rental income, and your final profit when you sell.

Let’s play it out. Say you agree to buy a €500,000 property in France when the EUR/USD rate is 1.05. Your cost is $525,000. But if the rate shifts to 1.10 by the time you complete, your cost suddenly jumps to $550,000. That’s an unplanned $25,000 hit. The same thing happens with your rental income—if your home currency gets stronger, your net yield shrinks.

Smart investors don’t leave this to luck. You can use simple financial tools to protect yourself from this volatility.

Hedging Strategies for Property Investors

- Forward Contracts: This is the go-to tool for property buyers. A forward contract lets you lock in an exchange rate for a future date. You agree on the rate today, removing all the guesswork and uncertainty about the final cost of your property. Simple and effective.

- Currency Options: This one is a bit more flexible. An option gives you the right, but not the obligation, to buy or sell a currency at a set rate. It protects you if the rate moves against you but still lets you benefit if it swings in your favour. It costs a bit more than a forward contract, but that flexibility can be worth it.

Working with a specialist currency broker is a must. They offer far better rates than high-street banks and give you the strategic advice you need to use these tools properly. This proactive step turns currency exposure from a wild risk into a managed part of your investment plan, protecting both your capital and your future returns.

Getting to Grips with Foreign Legal and Tax Rules

When you’re investing in foreign real estate, you absolutely cannot afford to wing it with the local laws and taxes. What’s standard procedure in London is almost certainly not how things are done in Lisbon, and a simple mistake can cost you dearly in fines or—even worse—put your ownership of the property at risk. This is where your homework, your due diligence, becomes your most critical task.

Before you even think about making an offer, you need to understand how property ownership is structured in your target country. They can vary dramatically, and the right choice has a massive impact on everything that follows.

Understanding Property Ownership Structures

How you legally hold the title to a foreign property affects your rights, your tax bill, and how you can eventually sell it. It’s a strategic decision you need to make early on.

- Freehold: This is the gold standard. You own the property and the land it stands on, forever. It’s the most common form of ownership in countries like the USA, Canada, and the UK.

- Leasehold: With this, you own the building for a fixed, long-term period—often 99 or even 999 years—but not the land itself. You’ll find this system in places like London and Dubai.

- Corporate Ownership: In some countries, it makes sense to hold the property through a company, either local or offshore. This can offer some protection from liability and potential tax benefits, but it also adds another layer of complexity and cost.

Don’t guess which one is right for you. This is a conversation you must have with a local legal expert who lives and breathes international property law.

Build Your In-Country Legal Team

Trying to navigate a foreign legal system on your own is a classic rookie mistake, and it’s one you can’t afford to make. Your local lawyer will be your most important partner on the ground. They’re the ones who will check the property title is clean, scrutinise the contracts, and make sure every part of the deal is above board.

When you’re looking for a lawyer, find someone who specialises in real estate deals for foreign buyers. Ask them for references from other expats they’ve worked with and double-check they aren’t also working for the seller or agent. A great lawyer does more than just stamp documents; they give you strategic advice to protect your investment.

Decoding the Real Costs: Taxes and Fees

The price you agree on is just the starting line. All the extra transaction costs can easily add a hefty chunk to your total investment, and these fees are completely different from one country to another. In the UK, for instance, stamp duty can be a major expense. Over in Spain, you’ll be paying a property transfer tax known as ITP.

And it doesn’t stop once you get the keys. You’ll have ongoing tax responsibilities to think about:

- Annual Property Taxes: These are the local equivalent of council tax.

- Rental Income Tax: If you rent out the property, almost every country will tax that income at their local rates.

- Capital Gains Tax: When you eventually sell, the government will want its share of your profit.

- Inheritance or Wealth Taxes: Some countries have specific taxes that could affect your estate plans down the line.

For anyone looking at Asian markets, getting the local tax details right is crucial. For example, a good guide to property tax in Hong Kong will show you exactly what financial obligations to expect.

Why Double Taxation Agreements Are Your Best Friend

A huge worry for overseas investors is getting taxed twice on the same income—once where the property is, and again back home. This is exactly why Double Taxation Agreements (DTAs) are so important.

A DTA is simply a treaty between two countries that ensures you don’t pay tax twice on the same money. It works by letting you claim a credit in your home country for the taxes you’ve already paid on your rental income or capital gains abroad.

For example, thanks to the US-Spain DTA, an American citizen earning rent from a flat in Marbella can use the Spanish taxes they’ve paid to reduce their US tax bill. Most developed countries have these agreements in place.

Find an accountant who specialises in expat and international tax. They’ll make sure you’re using these agreements properly to make your investment as tax-efficient as possible, which is fundamental to getting the best returns from your global property portfolio.

Managing Your Overseas Property from a Distance

Getting the keys is a huge milestone, but let’s be honest—that’s when the real work begins. Effective remote management is what turns a promising offshore investment into a genuinely passive, profitable asset. It’s the difference between a hands-off success story and a transatlantic headache.

Your first major decision is a simple one: hire a professional property manager, or do it yourself? There’s no single right answer here. The best path really depends on your own experience, where the property is, and how deep in the weeds you want to be with day-to-day operations.

The Professional Management Route

For most overseas investors, bringing in a reputable, local management firm is the logical first step. These companies are your boots on the ground, handling everything from marketing and tenant screening to rent collection and coordinating repairs.

Their local know-how is priceless, especially when you’re dealing with unfamiliar tenancy laws, finding reliable tradespeople, and navigating cultural nuances. But not all management firms are created equal, so vetting them is a critical piece of your due diligence.

- Check Credentials and Reviews: Look for licensed firms with a strong local reputation. Hunt down testimonials from other foreign property owners if you can.

- Analyse Fee Structures: Management fees typically land somewhere between 8-12% of the monthly rent. Watch out for extra charges for tenant placement or overseeing major repairs—make sure every cost is laid out transparently in the contract.

- Scrutinise the Contract: Your management agreement needs to clearly spell out responsibilities, termination clauses, and exactly how maintenance issues and funds are handled.

A great management company becomes your partner on the ground. They give you peace of mind and free you up to focus on the big picture, not leaky taps at 3 a.m.

The Self-Management Approach

Going it alone can be a tempting option, especially for seasoned investors or those with properties in places they know well. The biggest draw is saving on management fees, which adds directly to your net yield. Plus, you get total control over who you rent to and every decision made about your property.

But don’t underestimate the time commitment. You are the single point of contact for every tenant issue, from late rent to emergency repairs. This gets incredibly tricky when you’re juggling different time zones and potential language barriers.

“Nick Marr says that self-managing from a distance is achievable with the right systems in place. But you must be brutally honest about your capacity. A minor issue can quickly escalate if you’re not equipped to handle it swiftly and efficiently from thousands of miles away.”

Leveraging Technology for Remote Oversight

Whether you hire a manager or not, modern tech has completely changed the game for overseeing property from afar. The right tools can bridge the geographical gap, giving you more control and transparency when investing in foreign real estate.

- Property Management Software: Platforms like AppFolio or Buildium are brilliant for centralising everything—rent collection, expense tracking, and communication—even if you have a manager.

- Smart Home Devices: Things like smart locks are a lifesaver, letting you grant remote access to cleaners or tradespeople. Security cameras and smart thermostats offer real-time oversight and help manage utility costs.

- Digital Financial Tools: Using services like Wise or Revolut makes collecting rent and paying local bills in different currencies so much simpler and cheaper than traditional banks.

By weaving these technologies into your workflow, you create a system that keeps you connected to your investment, no matter where you are.

For a deeper dive into operational tactics, our guide on how to manage your overseas property from a distance offers a complete blueprint. Ultimately, the goal is to set up a management structure that ensures your property remains a high-performing, low-stress asset for years to come.

FAQs for Investing in Foreign Real Estate

What are the main risks of buying property abroad?

The primary risks include currency fluctuation, which can affect your purchase price and rental income; legal and tax complexities in an unfamiliar system; and the challenges of remote property management. Thorough due diligence, hiring local experts (lawyers, tax advisors), and using financial hedging tools can mitigate these risks significantly.

As a US citizen, where is the easiest place to buy property?

While “easy” is subjective, countries like Mexico, Costa Rica, and Panama are popular with US buyers due to proximity, established expat communities, and relatively straightforward property laws for foreigners. In Europe, Portugal and Spain have streamlined processes for foreign investors and are also very popular destinations.

How do I handle taxes on my foreign property investment?

You will likely have tax obligations in both the country where the property is located (for rental income and capital gains) and your home country. It is crucial to work with a tax advisor who understands international tax law and the relevant Double Taxation Agreements (DTAs) to avoid being taxed twice on the same income and to ensure full compliance.

What is the best way to find a trustworthy real estate agent overseas?

Look for agents with international certifications like Certified International Property Specialist (CIPS). Seek referrals from expat forums or your professional network. It’s also wise to check if they are part of a reputable global real estate network. Always interview multiple agents to find one who understands your specific investment goals and communicates clearly.

At HomesGoFast.com, we connect you with real estate agents, developers, and owners to simplify your search for global property. Explore thousands of listings and find your next investment today.

Discover International Property For Sale on HomesGoFast.com

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers? Go to

https://homesgofast.com/sell-overseas-property/