So, you're contemplating a property acquisition in Thailand and asking the critical question: "Can a foreigner legally own it?" The definitive answer is a qualified yes, foreigners can buy property in Thailand.

While Thai law restricts foreign nationals from owning land outright, this should not deter the discerning investor. There are several well-established and legally sound methods for international buyers to secure a condominium, house, or villa—particularly in prime markets like Bangkok, Phuket, and Koh Samui. This is not about exploiting clandestine loopholes; it is about understanding the official, government-approved structures designed to encourage foreign investment.

The optimal strategy depends entirely on the asset class. For those seeking a straightforward, direct ownership experience, a condominium is the most efficient route. However, if your ambition is a villa with a private garden or a standalone house, the approach will involve structures such as long-term leaseholds or the establishment of a Thai limited company.

For high-net-worth individuals and seasoned investors from the USA, Europe, and other global hubs, mastering these methods is the foundational step toward a strategic and secure acquisition.

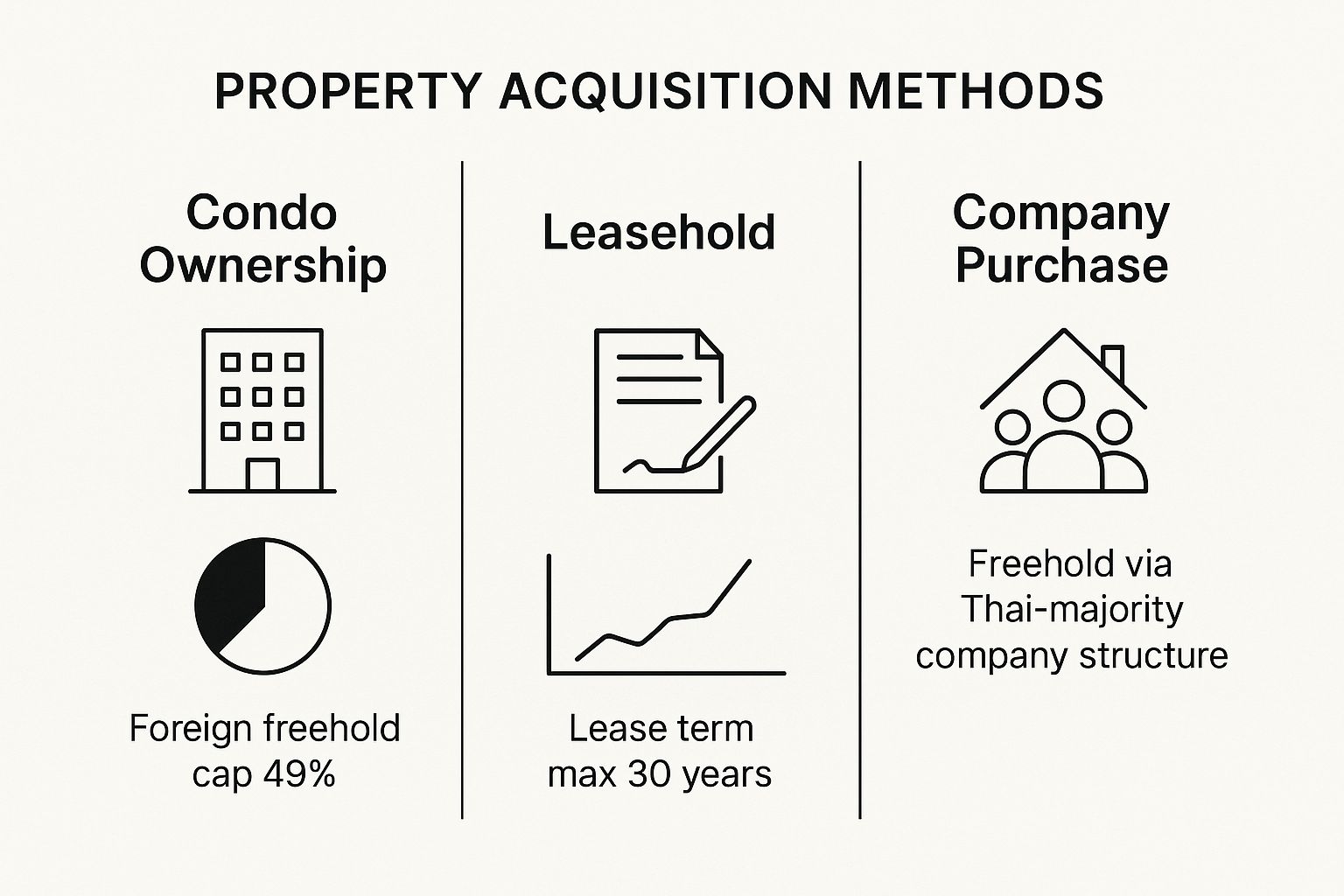

Foreign Property Ownership Options in Thailand at a Glance

To simplify the legal landscape, here is a concise comparison of the primary methods for a foreigner to secure property in the Land of Smiles. Each framework is structured for different asset types and investor objectives.

| Ownership Method | Property Type | Ownership Structure | Key Consideration |

|---|---|---|---|

| Condominium Freehold | Condominium Unit | Direct ownership in your personal name. | The most direct and secure route, but foreign ownership within the building cannot exceed 49% of the total unit space. |

| Long-Term Leasehold | Land, House, Villa | A registered lease of up to 30 years, typically renewable. | You do not own the land but possess secure, long-term rights to its use and enjoyment. Ideal for landed properties like houses. |

| Thai Limited Company | Land, House, Villa | The company owns the property freehold. | You control the company, but 51% of shares must be held by Thai nationals. Requires meticulous legal setup and ongoing compliance. |

This table outlines the core frameworks. As is evident, while direct land purchase is prohibited, there are clear, legal pathways to owning a condominium outright or controlling a house or villa through other secure and well-trodden structures.

Let us now dissect these popular methods. We will explore the specifics of acquiring a condominium freehold, how to leverage a long-term lease for maximum benefit, and the conditions under which a Thai limited company becomes a strategic choice. This will provide the practical knowledge required before examining the finer details of each option.

Understanding the Roots of Thai Land Law

To truly succeed in Thailand’s property market, one must appreciate not just the regulations, but the historical context from which they emerged. The laws limiting foreign ownership are not merely modern bureaucracy; they are deeply woven into the fabric of Thai history and its unwavering commitment to national sovereignty.

For any investor from the USA, Europe, or elsewhere, grasping this context is paramount. It explains why acquiring a condominium is a relatively seamless process, while purchasing land demands a far more sophisticated and structured approach.

A Legacy of Protection

At its core, Thai land law is about protection. This principle dates back to the 19th century when Thailand (then Siam) skilfully navigated the colonial pressures that subsumed many of its neighbours. Thailand was never colonised, a fact that engendered a powerful cultural and political imperative to retain control over its most valuable asset: its land.

This is not simply a bureaucratic obstacle; it is a reflection of national identity. The laws were initially implemented to prevent foreign powers from acquiring vast tracts of land, ensuring the nation’s destiny remained firmly in Thai hands. For today's investor, this means the answer to "can foreigners buy property in Thailand" is directly linked to respecting these profound historical foundations.

The Evolution of Land Legislation

This cautious stance towards foreign ownership was not a sudden decree; it was formalised over many decades. As far back as the mid-19th century, Thailand has consistently upheld legal barriers to foreign land ownership. During the reign of King Rama IV, regulations from 1856 prohibited foreigners residing in Thailand for less than 10 years from owning land in Bangkok’s central district.

A series of treaties and acts followed, each reinforcing these controls. This culminated in the foundational Land Act of B.E. 2497 (1954), which continues to serve as the cornerstone of property law today. For those interested in a deeper analysis, you can explore the detailed legislative history to understand how these early policies shaped the current legal landscape.

This history is what shapes the market you see today. The government has always walked a fine line, seeking to attract foreign investment for economic growth while safeguarding national assets. This explains why they created specific, controlled pathways like the Condominium Act—it welcomes foreign capital without ceding control of the land itself.

The Dangers of Nominee Structures

This protective legal environment is also why certain "workarounds" are so perilous. The most significant trap for inexperienced investors is the use of Thai nominee shareholders. This practice involves a foreigner establishing a Thai limited company to purchase land, with Thai citizens holding 51% of the shares nominally, but without any genuine investment or control. They are merely acting as a front.

Let's be unequivocal: Thai authorities are acutely aware of this scheme and consider it an illegal circumvention of the law. Engaging in a nominee arrangement is a high-stakes gamble with severe repercussions:

- Total Loss of Investment: The nominee can legally assert ownership of the property, leaving the foreign investor with no legal recourse.

- Severe Legal Penalties: Both the foreigner and the Thai nominee can face substantial fines and even imprisonment.

- Forced Sale of the Property: The government can order the company to divest the land immediately.

For any serious international investor, avoiding these structures is not merely advisable—it is essential for a secure and legitimate investment. By understanding this history, one can focus on transparent, legally sound strategies that genuinely protect assets in Thailand.

Buying a Condo: The Clearest Path to Ownership

For the majority of foreigners aspiring to own property in Thailand, the condominium market represents the most direct and attainable reality. Acquiring a condominium unit is the most straightforward method for an international buyer to have their name on a title deed, granting them outright ownership.

This is not a loophole; it is a well-defined legal pathway established by the Condominium Act B.E. 2522 (1979). This pivotal legislation was designed to create a secure channel for foreign investment in the property sector while maintaining firm control over land ownership. It is an intelligent balance that has fuelled development and attracted capital for decades.

The Critical 49/51 Rule Explained

The entire system of foreign condominium ownership rests on one simple but non-negotiable principle: the "49/51" rule. Adherence to this is paramount.

- The Foreign Quota (49%): Foreigners, whether individuals or corporate entities, can legally own up to 49% of the total combined floor space in any single condominium building.

- The Thai Quota (51%): The majority share, 51% of the building's saleable area, must remain in the ownership of Thai citizens or Thai-registered companies.

Envisage a condominium building as a pie. Foreign buyers can collectively own just under half of that pie. This ownership is freehold (evidenced by a Chanote title deed), which is the most secure form of property title in Thailand. It grants you complete control over your unit—you can sell it, lease it, or bequeath it to your heirs, provided the subsequent foreign buyer also fits within the 49% quota.

The Practical Steps to Secure Your Condo

Acquiring a condominium is not an impulse decision; it is a structured process. However, with diligent preparation and a competent professional team, it is a very manageable undertaking.

The absolute first step is to confirm the foreign ownership quota for the target building. Your agent or legal counsel must verify with the building's management office (the Juristic Person) and the Land Department that there is available capacity within the 49% foreign-owned allocation. Attempting to purchase a unit designated for the Thai quota will result in the transaction being rejected at the Land Department.

Once the quota is confirmed, comprehensive due diligence is essential. This is where your lawyer proves their value. They will need to:

- Verify the seller possesses a clean title deed (Chanote) with no encumbrances or legal claims.

- Check that the developer obtained all requisite construction permits.

- Ensure there are no outstanding management fees or utility bills associated with the unit.

The flow of foreign capital into this sector underscores its viability. In the first half of 2023 alone, foreign buyers were responsible for 10.8% of all condominium transfers nationwide, marking a 14.7% increase from the previous year. Chinese investors led this charge, accounting for nearly half of these transactions, with key markets like Chonburi and Bangkok seeing the most activity. You can review more details about these investment patterns from recent reports on Chinese influence in Thailand's property market.

The Financial Transfer: A Key Legal Requirement

Here is a critical detail that can derail many first-time buyers: you must prove the funds for the condominium purchase originated from outside Thailand. You cannot simply use cash or funds already held in a Thai bank account.

The government mandates a very specific process:

- You must transfer the full purchase price in a foreign currency (such as USD, EUR, or GBP) from an overseas bank account to a bank account in Thailand.

- For any amount exceeding $50,000 USD, the receiving Thai bank will issue a special document known as a Foreign Exchange Transaction (FET) form.

- This FET form is the essential evidence. It is the official proof the Land Department requires to register the property under your foreign name.

This step is an absolute prerequisite. Without this document, the ownership transfer cannot be completed. It is Thailand's mechanism for ensuring all foreign property investment is transparent and legitimate.

How to Secure Land and Houses with Smart Structuring

For ambitious international investors looking beyond a condominium, buying a house, villa, or a plot of land in Thailand takes a bit more finesse. Since foreigners can't directly own land, the key is to use established, legally-sound structures to secure your property. This isn't about finding sketchy loopholes; it's about using the right legal tools designed for this exact purpose.

The answer to whether foreigners can buy property in Thailand that isn't a condo lies in these methods. The two most common and legitimate paths are the long-term leasehold and setting up a Thai Limited Company. Each offers a different mix of control, security, and complexity, and knowing the difference is vital for anyone serious about owning landed property in hotspots like Phuket, Koh Samui, or Chiang Mai.

Securing Rights Through a Long-Term Leasehold

The most direct and popular method for a foreigner to buy a house in Thailand is through a long-term lease. Don't mistake this for a simple rental agreement. A proper Thai leasehold is a powerful legal tool that grants you extensive rights over the property for a very long time.

A Thai leasehold is a formal contract with a maximum initial term of 30 years. For it to be ironclad, the lease absolutely must be registered with the local Land Department. This official registration is what protects your rights against the landowner or anyone else for the entire term.

Here's what a well-drafted leasehold gives you:

- Secure Tenure: A registered 30-year lease gives you exclusive rights to live in, use, and even sublet the property.

- Renewal Clauses: While 30 years is the legal limit for one term, good lease agreements are almost always written with clauses for renewal. These typically allow for two more 30-year periods, potentially giving you control for up to 90 years.

- Inheritability: A properly structured lease can be made inheritable, meaning your heirs can take over the remaining lease term if something happens to you.

- Construction Rights: The contract can give you the right to build, renovate, or even demolish buildings on the land, giving you full control over the physical asset.

It is absolutely critical that your lease agreement is drafted by an experienced Thai property lawyer. While renewal clauses are standard, they are fundamentally contractual promises, not a 100% legal guarantee. A skilled lawyer will fortify these clauses to make them as binding as Thai law possibly allows, giving you the strongest security for your long-term investment.

Acquiring Property Via a Thai Limited Company

The other main route is to set up a Thai Limited Company to purchase the land or house. In this scenario, the company—which you control as the director—owns the property freehold. This is a more complex but ultimately more powerful structure, offering a greater degree of control than a leasehold.

But there’s a major string attached. Under Thai law, your company must have majority Thai ownership. This means at least 51% of the company’s shares have to be held by Thai nationals. As the foreign investor, you can hold the remaining 49%.

So how do you maintain control? It's all in the setup:

- You can be appointed the sole managing director, giving you exclusive authority over all company decisions, including what happens with the property.

- The company’s articles of association can be structured to give the minority foreign shareholder stronger voting rights on critical decisions.

- Different classes of shares can be created, giving preferential rights to you as the foreign shareholder.

Navigating the Legal Complexities and Risks

While the company structure is a solid option, it requires extreme care and perfect legal work. The biggest risk is the 51% Thai shareholding rule. Thai authorities are constantly on the lookout for "nominee" structures, where Thai shareholders are just names on a document, paid to hold shares without any real investment or involvement.

Using nominees is illegal. The consequences are severe, including fines, jail time, and the government forcing the sale of your property. Your Thai partners must be genuine investors who have put in their own capital and have a legitimate interest in the company.

This makes the Thai Limited Company a better fit for investors with legitimate Thai business partners or those undertaking larger commercial projects. For buying a simple residential home, the administrative headache—like annual audits and corporate filings—might be overkill compared to a strong, well-drafted lease. Your decision on which path to take for your land ownership in Thailand as a foreigner should only come after a deep dive with a qualified legal advisor who can weigh your specific goals and situation.

Navigating the Purchase Process and Associated Costs

Successfully acquiring property in Thailand is a methodical process, not an impulsive act. Understanding the key steps and financial implications is essential for ensuring a seamless transaction. This roadmap outlines what to expect and demystifies the costs, allowing you to budget with confidence.

Your first and most critical move, before making an offer, is to engage a reputable, independent lawyer. This is non-negotiable. They are your most crucial ally, responsible for conducting due diligence, verifying the title deed is unencumbered, checking for hidden debts or legal disputes, and scrutinising the purchase agreement to secure your interests.

Once legal checks are complete and you wish to proceed, you will typically sign a reservation agreement and pay a deposit. This secures the property while your lawyer drafts the main Sale and Purchase Agreement (SPA). The SPA is the legally binding document that details all terms, conditions, payment schedules, and responsibilities.

The Financial Landscape: Taxes and Fees

A primary concern for those asking, "can foreigners buy property in Thailand," relates to closing costs. Budgeting for these is essential to avoid unforeseen expenses at the Land Department. The main taxes and fees are typically shared between the buyer and seller, though the specific allocation is a point of negotiation to be defined in your SPA.

Here is a breakdown of what to anticipate:

- Transfer Fee: A standard 2% of the property’s official appraised value, usually split 50/50 between buyer and seller.

- Specific Business Tax (SBT): A 3.3% tax on the sale price or appraised value (whichever is higher). This applies only if the seller has owned the property for less than five years and is almost always paid by the seller.

- Stamp Duty: At 0.5% of the sale price, this is paid instead of the SBT if the seller has owned the property for more than five years. It is an alternative tax, not an additional one. The responsible party is negotiable.

- Withholding Tax: This is calculated based on the duration of the seller's ownership and their personal income tax rate. This is strictly the seller's responsibility.

Data from the Real Estate Information Centre consistently demonstrates the popularity of Thai property among international buyers. Even amidst market fluctuations, foreign buyers constitute a significant portion—often around 13%—of all condominium sales. In one recent nine-month period, 11,036 condo units were transferred to foreign buyers, with Bangkok (38.7%) and Chonburi (36.0%) being the dominant markets. This is not an anomaly but a sign of a mature and resilient investment landscape. You can find more analysis on Thai property price history to delve deeper into these trends.

The Final Step: Transfer of Ownership

The final stage is the transfer of ownership at the local Land Department office. On the appointed day, you (or your lawyer via Power of Attorney), the seller, and potentially a bank representative will convene to finalise the transaction.

This is the pivotal moment. All taxes and fees must be settled in full before officials will update the title deed (Chanote) with your name. For foreign buyers, you must also present your Foreign Exchange Transaction (FET) form—the non-negotiable proof that funds were transferred into Thailand from overseas.

Once the title deed is registered in your name for a condominium, or your lease is officially recorded for land, the property is legally yours. It is the final, official act that transforms your ambition of owning property in Thailand into a tangible asset.

Strategic Insights for the Modern Investor

Understanding the legal framework is fundamental, but making a truly astute acquisition requires more. Answering "can foreigners buy property in Thailand?" is not merely about legality—it is about determining if the investment aligns with your strategic objectives. A sophisticated investor analyses market dynamics, identifies growth corridors, and implements measures to protect their asset.

While Bangkok, Phuket, and Pattaya remain established powerhouses, astute capital is increasingly flowing into Thailand’s emerging hotspots. These areas often present superior capital appreciation potential and appeal to specific demographics, such as North American and European retirees seeking a more tranquil and cost-effective lifestyle.

Exploring Emerging Thai Property Markets

Looking beyond the traditional markets can yield significant returns. Keep these burgeoning regions on your investment radar:

- Chiang Mai: This northern city has long been a favoured destination for expatriates and retirees, and for good reason. It offers a cooler climate, a relaxed atmosphere, and a substantially lower cost of living compared to the southern coastal resorts. The property market here delivers exceptional value for those pursuing a blend of authentic culture and modern amenities.

- Hua Hin & Cha-am: Located on the Gulf of Thailand, these adjacent coastal towns are rapidly emerging as the preferred alternative for those who find Pattaya overly saturated. They attract a sophisticated mix of Thai and international residents, driving demand for high-quality villas and contemporary condominiums.

- Koh Lanta & Krabi: For those aspiring to the classic Andaman Sea lifestyle without the high density of Phuket, these locations offer immense potential. Infrastructure is improving annually, yet they have retained their authentic island charm, making them ideal for boutique resort-style residences and long-term rental investments.

Nick Marr, founder of Homesgofast.com, observes, "Thailand's unique blend of lifestyle appeal and sophisticated legal structures for foreign buyers keeps it at the forefront for global investors seeking both a home and a sound asset. The market's resilience and diversity offer opportunities across various risk appetites and investment horizons."

This enduring appeal is rooted in one key factor: Thailand offers a solution for every type of investor. The true secret to success is aligning your personal and financial objectives with the right location and property type.

Whether your priority is rental yield, long-term capital appreciation, or simply a magnificent place to reside, achieving this alignment is what distinguishes a good purchase from a great one. And let us be clear: engaging professional guidance from local legal and real estate experts is not a . It is an absolute necessity for navigating these markets and mitigating risk. This ensures your Thai property acquisition is not merely a transaction, but a calculated, rewarding investment.

Frequently Asked Questions About Thai Property

Entering a new property market like Thailand naturally raises numerous questions. If you are asking whether foreigners can buy property in Thailand, you are not alone. Most international investors face similar concerns regarding financing, long-term ownership security, and the necessity of legal counsel.

Let us address these common queries with clear, direct answers to help you proceed with confidence.

Can I Get a Mortgage in Thailand as a Foreigner?

The short answer is: it is exceptionally difficult. For non-resident foreigners, securing a mortgage from a local Thai bank is not a viable strategy for property acquisition. The vast majority of international buyers finance their purchases with cash or through funds secured in their home country.

While some international banks with a presence in Bangkok, such as UOB, may consider lending to a foreigner, this is a rare exception. Such offers are typically reserved for individuals holding a long-term Thai work permit, a demonstrable and stable income within Thailand, and a significant history of local residency.

For nearly all other international buyers, leveraging assets in your home country is a far more practical and reliable approach.

What Happens to My Leasehold Property After 30 Years?

Thai law limits a single lease term to a maximum of 30 years. This is a common point of concern for foreign investors, but standard practice, particularly for high-value properties, is to incorporate renewal options directly into the original contract.

A well-drafted lease agreement will typically include clauses granting you the option to renew for two additional 30-year terms, creating a potential total holding period of up to 90 years. It is crucial to understand, however, that this is a contractual right, not an automatic statutory one.

The real security of your 90-year lease comes down to the quality of the legal paperwork. A top-tier property lawyer will draft these renewal clauses to be as ironclad as possible, giving you the best possible protection for your long-term investment.

Do I Need a Thai Lawyer to Buy Property?

Yes. To be perfectly clear: engaging an independent, reputable lawyer is not merely advisable—it is an absolute necessity for any foreigner purchasing property in Thailand. Your lawyer is your most critical line of defence and your most valuable advisor.

Your legal counsel will manage the mission-critical tasks that protect your investment:

- Conducting Due Diligence: They will verify the authenticity of the title deed (Chanote), perform searches for any undisclosed debts or legal claims against the property, and confirm compliance with all local building regulations.

- Contract Review: They will meticulously analyse the Sale and Purchase Agreement to ensure it is drafted to protect your interests, not the seller's. Every term and responsibility will be clearly defined.

- Process Management: They will guide you through the often complex procedures of transferring funds and completing the final ownership registration at the local Land Department.

Relying on the lawyer provided by the seller or developer presents a significant conflict of interest. Your own independent lawyer is the only professional exclusively on your side, dedicated to ensuring your investment is secure.

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers

https://homesgofast.com/sell-overseas-property/