Buying a second home, particularly one overseas, is a significant financial undertaking that calls for a sophisticated, clear-headed strategy. When it comes to financing, you’re essentially looking at two main paths: you can either tap into the assets you already have, such as the equity built up in your main home, or you can secure a new loan, like a mortgage in the country where you’re buying. This guide is your map for navigating those choices, tailored for the discerning international investor.

Charting Your Path to a Second Home

Securing funds for an international property is an exciting goal, but it’s an entirely different discipline than buying your primary residence. You can expect lenders to be more stringent, require higher deposits, and you’ll have to navigate unique cross-border financial regulations. For anyone buying abroad, identifying the optimal financing route from the outset is the key to a successful acquisition.

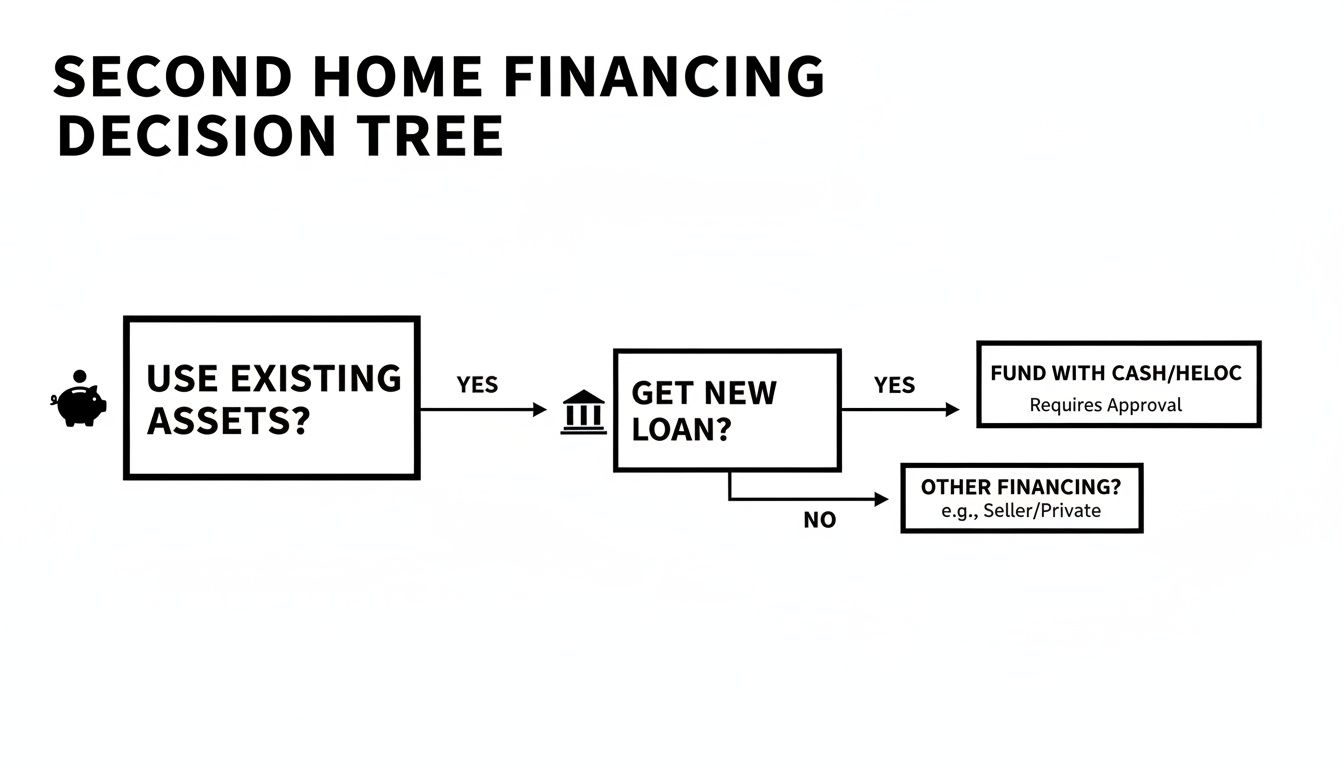

This decision tree gives you a bird’s-eye view of the fundamental choice you’ll be making.

As you can see, it boils down to using your existing capital or taking on new credit. The right choice for you will depend on your personal finances, risk appetite, and the specifics of the property you have your eye on.

Key Financing Considerations

As you delve into your second home financing options, a few critical factors will shape your journey. Your personal investment goals and overall financial health will be your compass here.

- Asset Leverage: Drawing from the equity in your primary home can be a quick and flexible way to access capital. This is a powerful move if you need to act decisively on a prime property in a competitive market.

- New Debt: Applying for a mortgage in the country where you’re buying integrates you with the local banking system. This can sometimes mean better rates, but it also requires a firm grasp of foreign regulations. Our guide on how to buy property abroad is an excellent starting point for understanding this process.

- Investment Strategy: If this second home is part of a wider investment portfolio, then exploring strategies for investing in real estate for passive income will significantly influence your financing decisions. It will help you decide whether to hunt for the lowest possible interest rates or prioritise swift access to capital.

Ultimately, both routes have their distinct advantages and disadvantages. In the sections that follow, we’ll break down each of these options in detail, giving you the clarity needed to execute a move with confidence.

Securing a Conventional International Mortgage

For many individuals venturing into international property, the most direct path appears to be securing a mortgage in the country of purchase. This traditional approach involves dealing with a local bank, which has the clear benefit of operating within that country’s established financial system. However, local lenders view non-resident buyers through a very different lens, and their criteria are invariably tougher than for domestic clients.

Understanding the Higher Bar for Foreign Buyers

When you begin researching second home financing options abroad, prepare for heightened scrutiny. Local lenders are focused on managing risk, and they perceive a greater risk with overseas clients. This means you’ll face a much more rigorous set of standards to qualify.

The rationale for tougher rules is simple risk management. If an economy takes a downturn, a borrower is far more likely to default on a second home mortgage—especially one in another country—than on their primary residence. Lenders require a substantial financial buffer to protect themselves against that eventuality.

This cautious mindset manifests in several key aspects of the application process.

Stricter Financial Requirements and Documentation

First, lenders will expect a significant down payment. We’re typically talking 25% to 40% of the property’s value. Committing that much capital demonstrates your seriousness and immediately lowers the bank’s exposure. For a look at what this means in popular locations, see our guide on minimum deposits for overseas mortgages.

Beyond the deposit, you will undergo an exhaustive affordability assessment. Be prepared to provide extensive paperwork that substantiates your entire global financial picture—income, assets, and any existing debts. This typically includes:

- Verified Income: Several years of tax returns from your home country.

- Asset Statements: Detailed records of your investments, savings, and other properties.

- Credit History: While your credit score from home does not simply transfer, lenders will want to see your credit reports to understand your financial behaviour.

- Proof of Funds: You’ll need to demonstrate the source of the funds for your deposit.

Successfully navigating this process is about meticulous preparation. For instance, if you are not a U.S. resident but are eyeing a second home there, investigating specialised mortgage loans available with an ITIN could be a game-changer.

The main challenge for many is simply gathering—and often translating—all these documents to meet a foreign bank’s specific requirements. This is where a local mortgage broker who specialises in assisting expatriates and non-residents can be invaluable. They know how to package your application for success. It is a demanding process, but a well-prepared application can unlock competitive local interest rates and give you a solid financial foothold in your new market.

Tapping into Your Home Equity to Fund a Purchase

Your primary residence is often much more than just a home; it’s a powerful financial asset. For astute international property buyers, the equity you’ve built up can be an incredibly flexible source of capital to purchase a second property. This strategy allows you to bypass the complexities of securing a foreign mortgage by arranging the funds in your home country, where you already have a solid financial track record.

This route almost always means a faster, smoother process. Instead of wrestling with foreign banking regulations and mountains of paperwork, you’re dealing with a familiar system. This speed can be a tremendous advantage when an excellent opportunity arises in a competitive market like Portugal’s Algarve or an emerging hotspot in South America.

Remortgaging and Equity Release

One of the most popular strategies is to simply remortgage your existing property. This involves replacing your current mortgage with a new, larger one and taking the difference in cash. That lump sum can then be used as a substantial deposit or even to buy your second home abroad outright. Our guide on the benefits of mortgage refinancing delves deeper into how this works.

However, remortgaging isn’t the right move for everyone, especially if you’ve locked in an excellent low rate on your main mortgage that you would be unwise to relinquish. This is where another set of powerful second home financing options comes into play.

“Using the equity in your primary home offers incredible agility,” says Nick Marr, founder of Homesgofast.com. “It allows investors to act decisively, which is crucial when a unique property comes to market. You’re essentially turning paper wealth into liquid capital for your next acquisition.”

Second Charge Mortgages and HELOCs

A second charge mortgage is a completely separate loan secured against your property, which sits behind your main mortgage. This has become a preferred option for UK homeowners wanting to unlock equity without touching their primary mortgage—a significant advantage in a world of fluctuating interest rates.

A Home Equity Line of Credit (HELOC) is another excellent tool, offering a revolving line of credit based on your equity. The key differences are straightforward:

- Second Charge Mortgage: You receive a fixed lump sum with a clear, structured repayment plan. This is perfect when you know the exact price of the international property you wish to buy.

- HELOC: This functions more like a credit card. You can draw funds as you need them, up to an agreed limit, giving you flexibility for expenses like renovations or furnishing costs after the purchase.

Both of these second home financing options for overseas property leave your favourable primary mortgage untouched while providing the capital you need to expand your property portfolio globally.

Exploring Specialist and Alternative Financing

For high-net-worth individuals and seasoned investors, conventional second home financing options are often just the starting point. When a standard mortgage or equity release doesn’t quite fit the puzzle of an international purchase, a world of bespoke, specialist financing opens up.

These alternative routes are built for flexibility, speed, and navigating the cross-border complexities that high-street banks tend to avoid.

This tier of financing is less about ticking boxes on a standard form and more about building a genuine partnership with financial experts who understand the nuances of acquiring assets around the globe.

Private Banking and Custom-Tailored Loans

Private banks operate on a completely different level from typical high-street branches. They offer services designed around the complex financial lives of their affluent clients, and when it comes to financing an overseas property, that relationship can be a game-changer.

Instead of a rigid, off-the-shelf loan product, they craft custom-structured lending solutions.

These arrangements can take your entire global portfolio into account—not just your monthly salary. This holistic view allows them to offer far more flexible terms, potentially larger loan amounts, and innovative structures that align perfectly with your broader investment strategy. They are experts at handling transactions in multiple currencies and across different legal systems, making them a powerful ally for any serious international buyer.

“For the global investor, looking beyond traditional lenders is key. Specialist financiers and private banks understand the nuances of cross-border transactions and can structure deals that high-street banks simply cannot accommodate.”

– Nick Marr, Founder of Homesgofast.com

Developer Financing in Emerging Hotspots

In many of the world’s most exciting emerging property markets—from coastal projects in South America to new builds in Panama—developer financing is a common and surprisingly effective option. To accelerate sales and attract international buyers, developers will often provide their own in-house financing packages.

This route comes with clear advantages:

- A Streamlined Process: The application and approval are usually much faster and less bureaucratic than dealing with a traditional bank.

- Attractive Terms: Developers might offer competitive interest rates or flexible deposit structures to secure a sale, particularly in a project’s early phases.

- Fewer Hurdles: They are often more comfortable working with foreign buyers and may have less stringent documentation requirements.

This can be an excellent way to gain a foothold in a new market, although it is always critical to conduct due diligence on both the developer and the financing terms. Exploring the vast range of International Property For Sale on our platform will often reveal developments offering these kinds of incentives. For new-builds, this direct path is one of the most practical financing options for a holiday home.

How Global Economics Shape Your Loan Options

Your ambition to buy a second home doesn’t exist in a vacuum. It’s directly linked to the macro-level world of global economics. What happens in a central bank in Washington or Frankfurt can absolutely affect the mortgage rate you’re offered for a villa in Spain. Understanding these forces is the first step to making a shrewd financial move.

Major economic shifts have a ripple effect that touches everything. When a powerhouse like the US Federal Reserve or the European Central Bank decides to raise interest rates, the impact is not just local. Credit conditions tighten globally, making it more expensive for everyone to borrow money—including you, whether you’re eyeing a property in Europe or a hotspot in South America.

Navigating Currency Risk and Market Volatility

One of the biggest challenges for international buyers is currency risk. This occurs when your mortgage is in one currency (e.g., Euros) but your income is in another (e.g., US Dollars). If the exchange rate suddenly shifts against you, the real cost of your monthly payments could increase overnight, turning a sound investment into a financial burden.

Savvy buyers mitigate this risk. They often work with currency exchange specialists to lock in rates or, in some cases, find loans denominated in their home currency.

A volatile market isn’t always a negative—it creates both risks and opportunities. A sudden currency swing might be a challenge, but it could also work in your favour, making your dream property instantly more affordable. The secret is to monitor economic news and be prepared to act when the timing is right.

Identifying Trends in Lending

Staying abreast of lending trends is crucial. You want to know if banks are feeling confident and loosening their purse strings, or if they’re tightening up. For instance, recent data from the UK shows a fascinating shift. Gross mortgage advances hit a substantial £80.4 billion in the third quarter—a 36.9% increase from the previous quarter. New commitments also climbed to their highest level since late 2022.

You can delve into the details yourself with these UK mortgage lending statistics on FCA.org.uk.

This isn’t just an abstract statistic; it signals renewed confidence and liquidity in a major market. For an international investor, that’s a green light. By staying informed about the health of the global economy, you can better predict shifts in second home financing options and position yourself to secure the best possible deal for your new property.

Navigating Country-Specific Lending Rules

Financing a villa on the Costa del Sol is a completely different undertaking than funding a new-build apartment in a high-growth South American market. For any global investor, recognising that second home financing options are not universal is the first, most crucial step. A one-size-fits-all approach is a recipe for frustration. Success comes from mastering the local lending landscape.

Established vs Emerging Markets

The lending environment shifts dramatically depending on whether you’re looking at an established European hub or a fast-developing market elsewhere.

- Established Markets (e.g., France, Spain, Portugal): These countries have mature, highly regulated banking sectors. Lenders have decades of experience dealing with foreign buyers, so their processes are well-defined—if rigorous. You can generally expect loan-to-value (LTV) ratios of around 60-70% for non-residents.

- Emerging Markets (e.g., Panama, Colombia): While the growth potential here is exciting, the mortgage systems for foreign nationals are often less developed. LTVs might be lower, and navigating the legal frameworks without an expert on the ground can be a significant challenge.

- View our Global Listings here

In either scenario, partnering with a local mortgage broker who specialises in non-resident applications is not just advisable—it’s essential for cutting through the red tape.

The Influence of Government Policy

National government policies can completely reshape the lending environment, often creating unexpected opportunities for international investors. Even when initiatives are aimed at domestic buyers, they send a strong signal about the government’s commitment to a stable and accessible property market, which is positive news for all.

Take the UK’s Mortgage Guarantee Scheme, for example. It was designed to help first-time buyers get onto the property ladder. Since its launch, it has supported 58,856 mortgage completions, with a remarkable 86% going to new homeowners. This kind of government backing builds confidence in the property sector, making lenders more comfortable and creating a more favourable climate for all types of second home financing options for investors. You can explore the full data and learn more about the scheme’s impact right here.

“The regulatory climate of a country is a direct indicator of its investment stability. A nation with clear, transparent lending rules for foreign buyers is sending a strong signal that it welcomes international capital.”

Ultimately, your financing strategy must be custom-built for the legal and financial reality of your chosen destination. Conducting your homework on local regulations isn’t just a box to tick—it’s a non-negotiable part of the process.

Frequently Asked Questions

What kind of deposit will I need for a second home abroad?

Prepare for a much larger down payment than for a primary residence. Lenders in other countries are more cautious with non-resident borrowers and typically require a deposit between 25% and 40% of the property’s value. This substantial deposit demonstrates your commitment and helps offset the higher perceived risk of cross-border lending.

Can I use a mortgage from my home country to buy abroad?

In most cases, this is not feasible. The vast majority of domestic banks will not secure a loan against a property located in a different jurisdiction with its own legal system. The most straightforward route is to obtain financing from a lender based in the country of purchase. The exception is for high-net-worth individuals, where international private banks may offer specialised cross-border solutions.

Will my home country credit score matter to an international lender?

Not directly. Your credit score from the USA, UK, or Europe does not automatically transfer to another country’s system. However, an international lender will still conduct a deep dive into your financial history. Expect to provide comprehensive proof of your financial health, including bank statements, tax returns, and credit reports from your home country to build a complete borrower profile.

Are interest rates higher for international second home mortgages?

Yes, it is prudent to budget for a slightly higher interest rate. Compared to a mortgage for your main home, the rate for a second property abroad often includes a small premium to compensate the lender for the increased risk. The final rate will depend on your financial profile, the property’s location, and the loan-to-value ratio.

How does currency exchange risk affect my mortgage?

Currency risk is a significant factor. If your mortgage payments are in a foreign currency (e.g., Euros) but your income is in your home currency (e.g., US Dollars), a negative shift in the exchange rate can increase the real cost of your monthly payments. Sophisticated investors often work with currency specialists to hedge against this risk or seek financing in their primary currency where possible.

Is developer financing a safe option in emerging markets?

Developer financing can be an excellent option in markets like Panama or parts of South America, often streamlining the buying process. However, it requires rigorous due diligence. It’s crucial to thoroughly vet the developer’s reputation, financial stability, and the terms of the financing agreement. Always have an independent legal expert review the contract before committing.

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers? Go to

https://homesgofast.com/sell-overseas-property/