It’s easy to get the wrong idea about Dubai real estate. Many assume you can just swoop in and buy a cheap house in Dubai, but the truth is a bit more complicated—and frankly, a lot more interesting for astute international investors.

While finding an absolute rock-bottom bargain is rare in a market renowned for its luxury, identifying and securing exceptional value is entirely achievable. This is especially true for savvy investors from the USA, Europe, and emerging markets who know where to look and, more importantly, how to look. The secret is to stop chasing a low price tag and start hunting for a high-potential asset in one of the world’s most dynamic cities.

Understanding Value in Dubai’s Dynamic Market

For discerning investors, “cheap” in the Dubai property world really means strategic value. It’s not about finding a dusty, forgotten villa for pennies. It’s about pinpointing properties in up-and-coming districts that are primed for significant capital growth and can deliver strong rental yields along the way.

Dubai is perpetually growing, always expanding. This constant evolution creates fresh pockets of opportunity, allowing investors to enter the market at a reasonable price point before a neighbourhood reaches its peak. It requires a degree of foresight—looking beyond the established glamour of Downtown Dubai or the Palm Jumeirah. The real victory is securing an asset that, while affordable today, is perfectly positioned to ride the wave of future infrastructure projects and community enhancements.

Current Market Realities

So, what does the market look like right now? Dubai’s property scene is in a phase of what could be termed mature growth. It is no longer the volatile ‘wild west’ of a decade ago.

Recent data from early 2025 indicates a market that is both robust and complex. While transaction volumes saw a slight dip in the first quarter, overall property prices continued their ascent, jumping 15.8% compared to the previous year. This signals solid confidence from both investors and first-time buyers.

More importantly, the quarterly price growth has moderated to a more sustainable 2.8%. This suggests a stable, less speculative environment—excellent news for serious, long-term investors. While this makes finding a truly “cheap” house a challenge, government initiatives and developer incentives are keeping mid-range options firmly on the table for international buyers.

Dubai Property Market Snapshot: What ‘Affordable’ Means Today

| Market Indicator | Key Trend | Implication for Value-Focused Buyers |

|---|---|---|

| Annual Price Growth | Sustained at 15.8% year-on-year | Competition is high, but equity growth potential is strong. |

| Quarterly Price Growth | Moderated to a stable 2.8% | The market is less volatile, allowing for more strategic, less rushed decisions. |

| Developer Incentives | Increased focus on post-handover payment plans | More flexible financing structures are available, especially in new communities. |

| Emerging Neighbourhoods | Areas like JVC, Dubai South, and DAMAC Hills 2 are leading sales volumes | The best value is often found just outside the prime central core. |

This table illustrates that while headline prices are up, the market’s structure offers clear pathways for value-focused buyers. The key is to look where the growth is headed, not where it has already been.

To truly spot an excellent deal in a luxury market, one must think like a professional. Understanding the fundamentals of an expert guide to Dubai property valuation is a game-changer. It helps you look past the asking price and see a property’s true, long-term worth.

Ultimately, the first step is to discard the notion that Dubai is completely out of reach. It is not. With the right strategy, international buyers can absolutely find and acquire high-value properties that meet all the right criteria. This guide is designed to provide you with the insights to do just that.

Exploring Dubai’s Most Affordable Neighbourhoods

To successfully buy a cheap house in Dubai, one must look beyond the dazzling postcards of Dubai Marina and Downtown. While those areas are aspirational, the real value for savvy international investors lies within the city’s emerging communities. These neighbourhoods offer much lower entry points without forcing a compromise on quality or future growth potential.

Location is paramount in real estate, and in Dubai, that means finding the sweet spot between today’s price and tomorrow’s potential. It requires due diligence—reviewing the city’s master plan, tracking new infrastructure projects, and understanding demographic shifts.

For anyone serious about finding a high-value, lower-cost property, a few key areas consistently stand out. They represent a smart pivot away from the saturated prime market and into zones of genuine opportunity.

Dubai Silicon Oasis (DSO)

Dubai Silicon Oasis is a perfect example of a self-sufficient community that brilliantly merges residential life with a bustling technology park. It is a complete ecosystem. This unique setup makes it a magnet for young professionals and families, which in turn means one thing for an investor: consistent rental demand.

Properties here are noticeably more affordable than in the heart of Dubai. You can find modern studio and one-bedroom apartments at prices that are tough to beat elsewhere in the city. The area is also fully equipped with schools, parks, and shops, offering a comprehensive lifestyle on your doorstep.

International City

Famous for its distinct, country-themed architecture, International City has long been the go-to spot for budget-conscious buyers and renters. It’s where you will find some of the lowest property prices in Dubai, making it an ideal entry point for first-time investors looking for high rental yields.

While it has a reputation for being densely populated, ongoing improvements and its strategic proximity to major business hubs maintain its relevance and demand. If your primary focus is on securing a low-cost asset with reliable rental income, International City remains a very compelling choice.

Nick Marr, founder of Homesgofast.com, advises, “Investors from the US and Europe often overlook areas like International City, but the rental yields here can be surprisingly robust. It’s about understanding the specific tenant demographic and focusing on well-maintained buildings to maximise your return.”

DAMAC Hills 2 (Formerly AKOYA)

If you’re seeking more space—perhaps a villa or a townhouse—then DAMAC Hills 2 presents a fantastic proposition. It’s located further inland, but the trade-off is substantial: larger properties for a fraction of the cost you would pay closer to the coast.

What makes DAMAC Hills 2 a strategic buy is its heavy emphasis on community living. The amenities are built for families and are a major selling point:

- Water parks and sports facilities: Including football pitches and tennis courts.

- Community centres: Packed with retail and dining options.

- Green open spaces: A huge draw for anyone seeking a suburban feel.

This community is a long-term play on Dubai’s inevitable expansion. It is an opportunity to acquire a significant property for your money in an area perfectly positioned for future growth as the city pushes outwards.

Jumeirah Village Circle (JVC)

Jumeirah Village Circle hits the perfect trifecta of affordability, location, and lifestyle. It has rapidly become one of the most popular areas for both buying and renting in Dubai, especially with expatriate families who desire convenience without the prime-location price tag.

The area is known for its diverse mix of apartments, townhouses, and villas. Its unique circular layout, dotted with dozens of parks, creates a genuinely family-friendly atmosphere. With average prices still comfortably below more established communities, JVC offers a realistic path to buy a cheap house in Dubai without feeling disconnected from the city’s buzz.

Your next step is to explore the best properties in these areas on Homesgofast.com.

Gaining a Strategic Edge with Off-Plan Properties

For international investors looking to buy a cheap house in Dubai, the off-plan market is where the real strategic advantage lies. It is a simple concept: you purchase a property directly from a developer before it is built. Doing this often means locking in a price significantly lower than what you would pay for a completed, ready-to-move-in home. This is the inside track for entering the market with a much more favourable cost basis.

But it’s not just about the sticker price. Developers understand they need to sweeten the deal, so they often roll out incredibly attractive and flexible payment plans for their off-plan projects. These schedules allow you to spread the cost over the entire construction period. It’s a game-changer, removing the need for a massive upfront lump sum and making the investment far more manageable. Frankly, it is a key reason why so many seasoned buyers focus on this segment of the market.

Understanding the Off-Plan Landscape

Diving into the off-plan market requires a clear-eyed view of both the risks and the rewards. The upside is immense—your property’s value could appreciate substantially by the time you receive the keys. But that potential is entirely dependent on one thing: the developer’s ability to deliver a quality project on time. Due diligence is not merely a suggestion; it is imperative.

Dubai’s real estate sector is buzzing with activity. In the first half of 2025 alone, the Dubai Land Department saw around 94,000 residential sales transactions, a hefty 23% increase year-on-year. This has naturally pushed prices up across the city. However, off-plan projects in emerging communities remain a vital source of affordable options, creating a gateway for investors who might otherwise be priced out of prime central districts.

Vetting Developers and Securing Your Investment

Success in the off-plan world boils down to meticulous research on the developer. You need to investigate their track record. Have they completed past projects on schedule? What is the build quality like? Sticking with reputable developers who have a long and proven history in Dubai is your best protection. For a deep dive into one of the major players, you might find our complete guide to Azizi Developments for international buyers useful.

A non-negotiable step in any off-plan purchase is ensuring the project is registered with the Dubai Land Department (DLD) and that your funds are protected through an approved escrow account. This legal safeguard ensures your payments are tied directly to construction milestones.

Finally, you must get forensic with the Sales and Purchase Agreement (SPA). This is the legally binding contract that outlines every term, condition, completion date, and specification. I cannot stress this enough: have a qualified legal professional review the SPA before you consider signing. It is the single most important step to ensure your interests are protected from start to finish.

Navigating the Legal Process for Foreign Buyers

For any international investor, mastering Dubai’s legal framework is not just a good idea—it is non-negotiable. The good news is that the process is surprisingly transparent and well-regulated. You simply need to know the key steps to ensure a smooth transaction when you buy a cheap house in Dubai.

The entire system is structured to protect both the buyer and the seller, making it a secure jurisdiction in which to invest capital.

Freehold Versus Leasehold Ownership

First, you need to understand the two main types of property ownership available to foreigners in Dubai. This is a critical distinction that will shape your entire investment strategy.

Freehold ownership is what most international buyers seek. It grants you absolute ownership of both the property and the land it is built on. You can sell it, rent it out, or pass it down to your heirs without restriction.

Leasehold ownership, on the other hand, gives you the right to use a property for a fixed term—usually up to 99 years—but you do not own the land. As a foreign national, you can only purchase property in specific designated freehold zones. You will recognise the names: Dubai Marina, Jumeirah Village Circle (JVC), and Downtown Dubai are all popular examples.

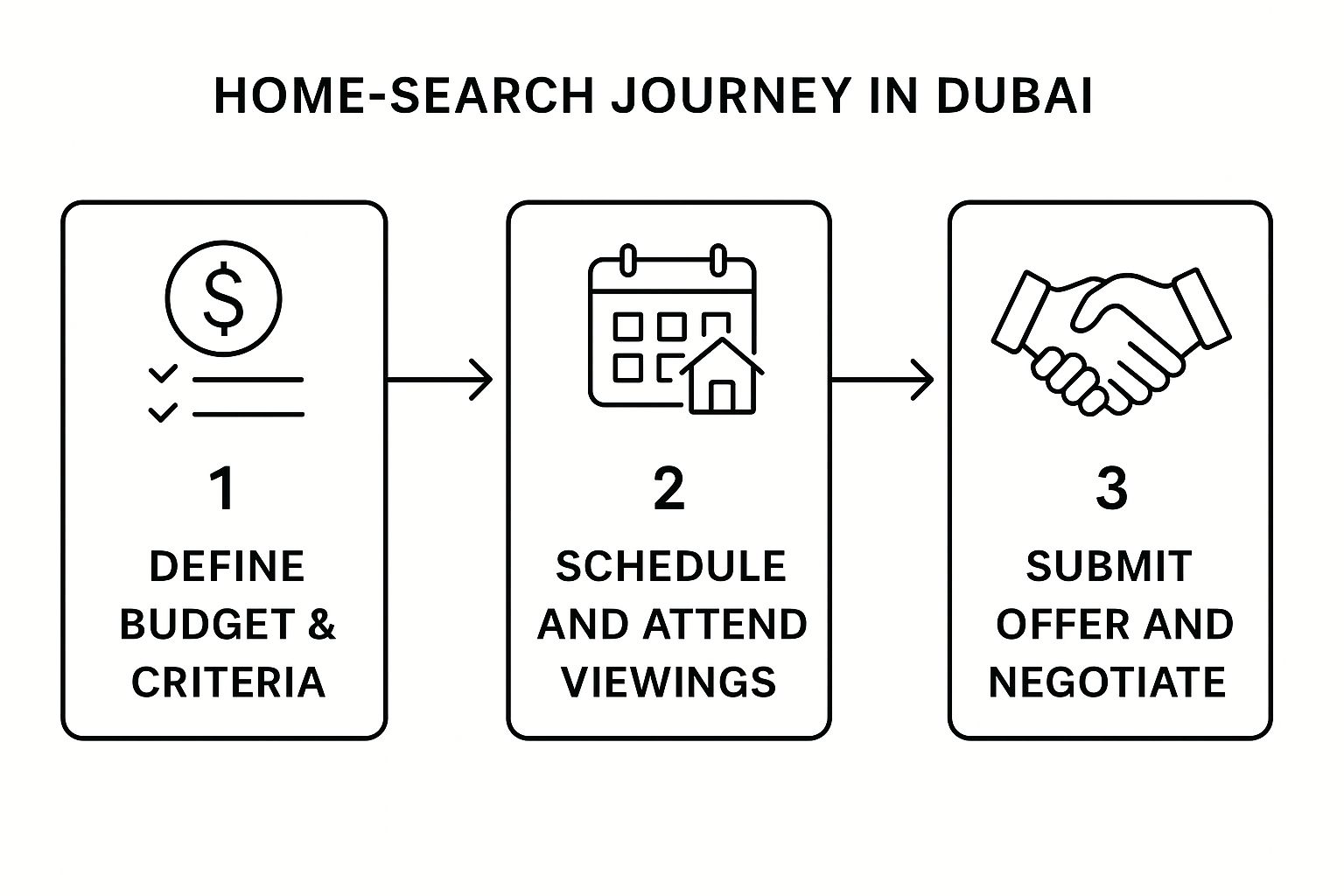

Key Stages of the Property Purchase

The journey from finding a property to holding the title deed involves several clear stages. Each step is designed to formalise the agreement and legally secure the deal for all parties.

This infographic breaks down the initial part of the journey, from defining your budget to making an offer.

As you can see, it all begins with financial planning before you start looking. Once you move past these initial steps and your offer is accepted, the official legal process commences.

- Memorandum of Understanding (MOU): Once you and the seller have agreed on a price, you will sign a formal sales agreement. In Dubai, this is often called an MOU or “Form F.” This document locks in the terms and conditions of the sale. It is almost always accompanied by a security deposit, which is typically 10% of the property’s value.

- No Objection Certificate (NOC): Next is obtaining a No Objection Certificate from the property developer. This is a crucial document confirming the seller has no outstanding debts or service charges tied to the property. The developer issues the NOC after a fee is paid.

- Title Deed Transfer: This is the final step where the transaction becomes official. The transfer of ownership happens at the Dubai Land Department (DLD). Both you and the seller (or your legally appointed representatives) need to be present. Once the full purchase price and all fees are paid, the DLD issues a brand-new title deed in your name.

A critical piece of advice: ensure you understand all associated costs upfront to budget accurately. While Dubai has no annual property tax, there are several one-off government and professional fees you will pay during the transfer.

Breakdown of Associated Costs

Here is a quick rundown of the typical fees you can expect:

- Dubai Land Department (DLD) Fee: 4% of the property’s purchase price.

- Property Registration Fee: This is a fixed administrative cost, usually around 4,000 AED for properties valued under 500,000 AED.

- Real Estate Agent Commission: Expect to pay 2% of the purchase price, plus a 5% Value Added Tax (VAT) on the commission amount.

- Developer NOC Fee: This can vary considerably, from 500 to 5,000 AED, depending on the developer.

- Mortgage Registration Fee (if applicable): If you are securing a mortgage, you will pay 0.25% of the loan amount to register it.

By familiarising yourself with this straightforward legal path and its costs, you can move forward with confidence. What starts as a goal to buy a cheap house in Dubai can quickly become a secure and successful reality.

How to Finance Your Dubai Property Purchase

Securing the right financing is a make-or-break factor for most international investors. You might have your heart set on buying a cheap house in Dubai, but turning that aspiration into reality means navigating the local financial landscape. For non-residents, there are plenty of solid options, though the regulations differ slightly from what you may be accustomed to in the USA or Europe.

First, be prepared for a higher down payment. UAE regulations require non-resident buyers to provide a minimum of 20% for properties valued under AED 5 million. This is a crucial figure to have at the forefront of your budget from day one.

Comparing Your Financing Avenues

When you start seeking a mortgage, you will find three main paths available to international buyers. Each has its own characteristics and benefits that can significantly shape your investment strategy.

- UAE-Based Banks: Local players like Emirates NBD or Mashreq have deep expertise in the Dubai property market. They understand the intricacies of local property law and often have strong relationships with developers, which can seriously streamline the process.

- International Lenders: Major global banks like HSBC typically have a strong presence in Dubai. If you already bank with one in your home country, you might find their application process more familiar and straightforward.

- Specialised Mortgage Brokers: A good broker can be your secret weapon, especially as a non-resident. They have access to a vast range of products from different banks and can identify the best rates and terms for your specific situation, saving you considerable time and effort. It is well worth looking into how to get expert overseas finance advice for your property purchase to see if this is the right approach.

Alternative Routes and Getting Ahead

Do not limit your thinking to traditional mortgages. Smart investors always keep an eye out for developer payment plans. These are especially common with off-plan properties and can be a fantastic deal. They often allow you to start with a smaller initial deposit and spread the remaining payments over the construction timeline. It is a strategic way to lock in a property at today’s price without needing a massive lump sum upfront.

A crucial tip I always give buyers: get your mortgage pre-approval before you begin making offers. It demonstrates to sellers and agents that you are a serious, qualified buyer and places you in a much stronger negotiating position.

To prepare, start compiling your key documents: your passport, proof of income (such as salary certificates and recent bank statements), and a clear overview of your existing assets and liabilities. For anyone weighing their options, understanding how to finance rental property can offer valuable insights that apply almost anywhere.

Final Considerations for a Smart Investment

Finding a great deal to buy a cheap house in Dubai is just the first step. The true success of your investment hinges on what you do after you have identified a property that looks good on paper. A low sticker price is fantastic, but the genuine value reveals itself over time through careful planning and foresight.

Your final checks should focus on the less obvious details: ongoing costs, realistic returns, and the future trajectory of the neighbourhood.

One of the biggest pitfalls for new investors is overlooking service charges. These are annual fees that cover everything from swimming pool maintenance and security to the upkeep of common areas. In a city like Dubai, known for its impeccable standards, these charges can take a significant bite out of your net returns. Always request a clear breakdown before you consider signing on the dotted line.

Forecasting Realistic Returns

Calculating your potential return on investment is not a guessing game. You need to project both your rental income and potential capital growth using solid data, not just wishful thinking.

For a deep dive into the numbers, our guide on how to calculate rental yields is an excellent resource that provides a proper framework. If you are considering flipping the property, a Real Estate Flip Profit Estimator can also be incredibly useful for projecting profits and shaping your strategy.

Keeping an eye on the broader market provides crucial context. A recent report from ValuStrat, for example, underscored the market’s heat in 2025. While villa prices shot up by an annual rate of 29%, the growth was far from uniform. Prime locations saw incredible surges of over 40%, but more affordable communities like International City posted a more modest—but still very healthy—gain of around 11%.

This data is a perfect reminder that while the market is buoyant, your choice of neighbourhood is absolutely critical.

“A smart Dubai investment isn’t just about the entry price; it’s about the exit strategy and the income generated along the way. Focus on communities with planned infrastructure upgrades—new metro lines or shopping centres often precede significant value appreciation.” – Nick Marr, HomesGoFast.com Founder.

Finally, do not forget the non-financial aspects. Does the community have the right atmosphere for your target tenant, or even for you? A property might seem like a bargain, but if it is in an undesirable area with poor amenities, it is no deal at all. The best decision will always strike a balance between the price, its future potential, and the quality of life it offers.

Answering Your Key Questions About Buying in Dubai

When you’re looking to buy property in a new country, a lot of questions arise. It is completely normal. Resolving these early on provides the confidence to move forward. Here are a few of the most common queries we receive from international buyers.

Can Foreigners Really Own Property?

Yes, absolutely. This is one of the most significant and welcome changes in Dubai’s recent history. Back in 2002, the law was amended to allow foreign nationals to buy property in specially designated “freehold” zones.

This is not a lease or a complicated arrangement—it is full, outright ownership of the property and the land it sits on. Popular locations like Dubai Marina, JVC, and Downtown Dubai are all freehold areas. So, you can buy a cheap house in Dubai without any special permissions, as long as you focus on these zones.

What Are the Real Hidden Costs?

The sticker price is just the beginning. It is crucial to budget for the one-time fees that accompany any property transaction in Dubai. The main one is the Dubai Land Department (DLD) transfer fee, which is a flat 4% of the property’s final sale price.

But there are a few others to keep on your radar:

- Real Estate Agent Commission: This is usually 2% of the purchase price, paid to the agent who assisted you.

- Mortgage Registration Fee: If you are securing a mortgage, you will pay 0.25% of the loan amount to the DLD to register it.

- Developer NOC Fee: For resale properties (anything not bought directly from the developer), you will need a No Objection Certificate. The fee varies, but it is an essential step.

Can a Property Purchase Lead to Residency?

It certainly can, and for many investors, this is a major draw. Buying property in Dubai can be your direct path to securing a UAE residence visa.

An investment of just 750,000 AED (approximately £160,000 or $204,000 USD) makes you eligible for a 2-year residence visa. If you are seeking more long-term stability, a larger investment of 2 million AED could qualify you for the coveted 10-year Golden Visa. It is a fantastic perk that turns a property purchase into a lifestyle investment.

At HomesGoFast.com, we make it simple to find your perfect place in Dubai. You can browse thousands of listings and get connected with trusted agents who know the market inside and out.

👉 Find your Dubai property on Homesgofast.com

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers

https://homesgofast.com/sell-overseas-property/