Before you consider investing in a property, whether in Lisbon, Miami, or an emerging market in Latin America, you must first master how to calculate rental yields. This is not merely industry jargon; it is the fundamental metric that reveals a property’s true income-generating potential relative to its cost.

Think of rental yield as the universal language of asset comparison. At its core, the calculation is straightforward: divide the property’s annual rental income by its total cost. This single figure cuts through market noise, allowing you to compare a beachfront villa in Brazil to a city-centre flat in Warsaw on a level playing field.

What Is Rental Yield and Why It Matters for International Investors

For any serious international property investor, rental yield is the definitive measure of an asset’s cash flow performance. It is entirely distinct from capital appreciation—the increase in the property’s value over time. While both are critical components of your total return, yield provides a real-time snapshot of how effectively your capital is working for you right now.

A strong yield signifies a healthy relationship between a property’s acquisition cost and its capacity to generate income. It is the foundational number that enables objective, data-driven decisions, whether you are evaluating a new development in a South American hotspot like Colombia or a classic apartment in a prime European city.

Gross vs Net: The Two Sides of Yield

When discussing how to calculate rental yields, it is crucial to differentiate between the two primary types: gross and net. Each tells a different, but equally vital, part of the investment story.

- Gross Rental Yield is the high-level, preliminary calculation. You simply divide the total annual rent by the property’s purchase price and associated acquisition costs. It is useful for a first glance but can be dangerously misleading as it ignores all operational expenses.

- Net Rental Yield is the metric that truly impacts your bottom line. This is where professional investors focus their attention. It provides a far more accurate picture of profitability by subtracting all annual expenses—such as maintenance, insurance, property management fees, and local taxes—from your rental income before dividing by the total property cost.

The disparity between these two figures can be substantial. For instance, recent US market data shows that average gross yields are often 1 to 2 percentage points higher than the net figure. The national average gross yield was 6.51%, but this varied significantly, from 7.82% in cities like Portland down to just 4.63% in high-cost areas like San Francisco. For a deeper dive into market-specific data, the Global Property Guide offers some excellent rental yield analysis.

To provide a clearer picture, here is a breakdown of how the two yields compare.

Gross vs Net Rental Yield at a Glance

This table offers a simple comparison to help you understand what each metric includes and why the net figure must be prioritised for accurate financial planning.

| Metric | Gross Rental Yield | Net Rental Yield |

|---|---|---|

| Formula | (Annual Rental Income / Total Property Cost) x 100 | ((Annual Rental Income – Annual Expenses) / Total Property Cost) x 100 |

| What It Includes | Only the total rent collected over a year. | Rent, plus all operating costs like taxes, insurance, and repairs. |

| Best For | Quick, high-level property comparisons. | Accurate financial planning and forecasting actual profit. |

| Key Limitation | Ignores all the costs of owning the property. | Requires more detailed data collection. |

Ultimately, while the gross yield might initially catch your eye, the net yield is what truly funds your investment goals.

“Too many investors get seduced by a high gross yield advertised by a developer,” notes Nick Marr, founder of Homesgofast.com. “True profitability lies in the net figure. Understanding your real costs is the difference between a successful international investment and a financial drain.”

Focusing on the net yield is the only way to protect yourself from overestimating returns. It provides the clarity you need to build a resilient and genuinely profitable global property portfolio. Mastering this calculation is not just a good idea—it is the first real step toward becoming a truly astute international investor.

A Practical Guide to Calculating Gross Rental Yield

Gross yield is a rapid, preliminary calculation that gives you a high-level snapshot of an investment’s potential. It is the perfect metric for swiftly comparing multiple properties on the market, helping you create a shortlist before you commit to deeper, more time-consuming analysis. Knowing how to calculate rental yields at this stage is a foundational skill every serious investor must possess.

Think of it as your initial filter. The formula itself is incredibly simple, requiring just two figures: your estimated annual rent and the total cost to acquire the property. It is all about separating promising opportunities from the duds.

Defining Your Inputs

Before using a calculator, you must get your numbers right. This is where many novice investors falter.

First, you need the Annual Rental Income. This is your projected gross rent over a full year. To ensure this figure is grounded in reality, you must research current rental rates for comparable properties in your target area. A quick search on a platform like Homesgofast.com can provide a solid baseline. It is also prudent to build in a buffer for vacancies—assuming a one-month vacancy per year is a common and sensible measure.

Next, you must establish the Total Property Purchase Cost. This is a critical step. The total cost is not merely the sale price. To gain an accurate picture, you have to include all expenses tied to the acquisition. These typically include:

- Stamp duty or transfer taxes, which can vary dramatically from one country to another.

- Legal fees for conveyancing and contract reviews.

- Surveyor or inspection costs to ensure the property is structurally sound.

- Any immediate, essential renovation costs needed to make the property tenant-ready.

A Real-World Example in Lisbon

Let’s walk through a real-world scenario. Imagine you are evaluating a two-bedroom apartment in Lisbon, Portugal—a market consistently popular with international buyers.

- Purchase Price: €350,000

- Acquisition Costs (Taxes & Fees): €25,000

- Total Property Cost: €375,000

After checking local listings, you determine that similar apartments are renting for approximately €1,800 per month.

- Annual Rental Income: €1,800 x 12 = €21,600

The formula for gross yield is straightforward:

(Annual Rental Income / Total Property Cost) x 100 = Gross Rental Yield (%)

Now, let’s apply it to our Lisbon apartment:

(€21,600 / €375,000) x 100 = 5.76% Gross Rental Yield

This quick calculation gives you a solid benchmark. You can now compare this 5.76% figure against other properties in Lisbon or even contrast it with potential deals in other global cities, whether it’s Miami or an emerging hotspot in South America like Cartagena, Colombia.

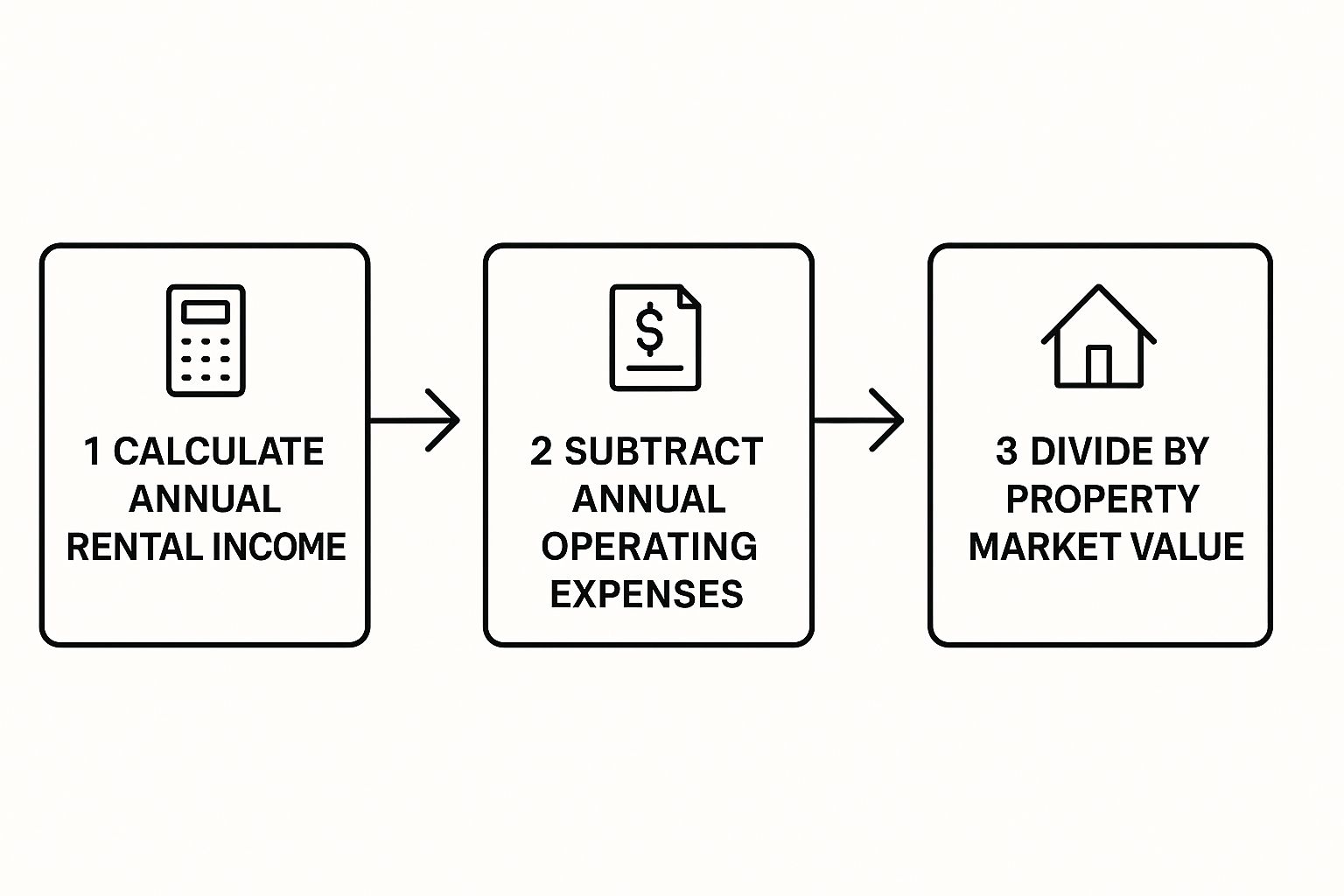

This infographic breaks down the core steps of the rental yield calculation.

As the visual shows, getting from raw rental income to a final yield means subtracting your expenses and dividing by the property’s true cost—a process that is absolutely essential for an accurate analysis.

Calculating Net Rental Yield for True Profitability

This is where the analysis becomes serious. While a gross yield calculation is a useful starting point, it is the net rental yield that tells the true story of a property’s performance. It is the metric that separates the sophisticated investor from the amateur.

Net yield cuts through the noise and shows you what you are actually earning after all bills are paid. Getting this right is your best defence against overpaying for an asset that looks great on paper but underdelivers in reality. The formula is a simple but crucial evolution of the gross calculation:

((Annual Rental Income – Annual Operating Expenses) / Total Property Cost) x 100 = Net Rental Yield (%)

The real work—and where accuracy is paramount—lies in identifying and quantifying every single one of those operating expenses.

Building Your Real-World Expense Checklist

To achieve an honest net yield, you need a detailed list of every cost associated with owning and running the property. These costs can vary dramatically from one country to another, so you absolutely must conduct thorough local due diligence.

Here is a baseline checklist of expenses you must factor in:

- Property Taxes: This is a major expense and varies everywhere. In the UK, it’s Council Tax. In Portugal, it’s IMI (Imposto Municipal sobre Imóveis). In the US, it can vary by state, county, and even city.

- Landlord Insurance: Non-negotiable. It protects your building, and many policies will also cover lost rent if the property becomes uninhabitable.

- Maintenance & Repairs Fund: A wise investor always allocates funds for this. A good rule of thumb is to budget 1%–2% of the property’s value each year. For a €375,000 property, that’s between €3,750 and €7,500 annually.

- Property Management Fees: If you are not managing it yourself, expect to pay an agency between 8%–12% of the monthly rent. This fee is a significant drag on your yield, so it must be included.

- Tenant-Finding Fees: Even if you self-manage, you might pay an agent to find and vet tenants. This could be a flat fee or as much as a full month’s rent.

- Service Charges or HOA Fees: Essential for apartments or homes in managed communities. These cover the upkeep of common areas, security, and shared amenities.

- Ground Rent: A key consideration for leasehold properties, especially in markets like the UK.

- Vacancy Costs: No property is occupied 100% of the time. Astute investors account for at least one month of vacancy a year (around 8.3% of annual rent) to cover tenant turnover.

Net Yield in Action: The Lisbon Example Revisited

Let’s return to our two-bedroom apartment in Lisbon. We know the total cost was €375,000 and the annual rent is €21,600. Now, let’s incorporate some realistic operating costs to see what happens.

- Annual Property Tax (IMI at 0.35%): €1,312

- Landlord Insurance: €300

- Maintenance Fund (a conservative 1.5%): €5,625

- Vacancy Provision (one month’s rent): €1,800

- Property Management (10% of collected rent): €2,160

Total Annual Operating Expenses: €1,312 + €300 + €5,625 + €1,800 + €2,160 = €11,197

Let’s run the numbers with the net yield formula:

((€21,600 – €11,197) / €375,000) x 100 = 2.77% Net Rental Yield

And just like that, the attractive 5.76% gross yield is slashed to a far more sober 2.77%. This is precisely why the net yield is the only figure that truly matters for your financial planning.

This kind of adjustment is supported by decades of data. While property can deliver fantastic returns, the net income is always at the mercy of local costs, taxes, and regulations. Factors like rent controls can dramatically alter your bottom line, which is why this level of analysis is so crucial. To dig deeper into these long-term dynamics, you can explore the data on housing returns from the Federal Reserve Bank of San Francisco for a broader perspective.

Advanced Factors for International Property Investors

For the savvy international investor, determining your true rental return goes far beyond local property taxes and a basic maintenance budget. Once your portfolio crosses borders, you are operating in a different league with a new layer of complexity—one that can either supercharge your returns or quietly erode them.

Grasping these variables is what separates a good investment from a great one, whether you are buying in an established hub like London or a fast-moving emerging market like Mexico City. A simple, surface-level net yield calculation is insufficient.

Navigating Currency Fluctuations

The most significant and unpredictable factor for any international investor is currency risk. You collect rent in one currency but measure your success in another. Even minor shifts in exchange rates can have a massive impact on your bottom line.

Consider a US investor who buys an apartment in London and collects rent in pounds sterling (GBP). If the US dollar strengthens against the pound, that rental income is suddenly worth less when converted back. Conversely, if the dollar weakens, the value of that same rent cheque receives a welcome boost.

This volatility affects not only your monthly cash flow but also the long-term value of your asset when you decide to sell. A property that appreciates by 10% in its local currency could still result in a net loss if that country’s currency drops 15% against your home currency over the same period. Experienced investors often use financial instruments like currency hedging to mitigate this risk.

Understanding International Tax Obligations

Taxation is another minefield you must navigate with precision. Owning property abroad often means you are liable for taxes in both your home country and the country where your property is located. The situation can become complex, quickly.

Here are a few key tax issues that non-resident landlords encounter:

- Withholding Tax: Many countries will automatically deduct a withholding tax from rental income before you see a penny of it. It is critical to know this rate beforehand.

- Double-Taxation Treaties: These are agreements between countries designed to prevent you from being taxed twice on the same income. Understanding the treaty between your home country and your investment location is non-negotiable for an efficient tax strategy.

- Capital Gains Tax: The rules for taxing profits when you sell a property vary wildly from one country to the next. Some offer significant breaks for long-term holds, while others impose high tax rates on non-residents.

The Hidden Costs of Remote Management

Managing a property from thousands of miles away comes with its own unique set of costs that you must integrate into your net yield calculation. While you may have budgeted for standard property management fees, international ownership brings more to the table.

Do not forget to account for factors like:

- International Bank Transfer Fees: Moving money across borders is not free. Those transfer fees can add up significantly over a year.

- Legal & Accounting Fees: You will almost certainly require specialised legal and accounting advice in both countries, and that expertise comes at a premium.

- Travel Costs: Making periodic trips to inspect your property or meet with your local team is a very real—and necessary—business expense.

“Investors often underestimate the ‘hassle factor’ of overseas ownership,” says Nick Marr of Homesgofast.com. “These small, persistent costs can trim a significant amount from your expected net yield if not budgeted for properly.”

Getting a handle on these moving parts is essential. A successful international investment demands a yield calculation that is as global as your portfolio.

Proven Strategies to Maximise Your Rental Yield

Calculating your rental yield is just the first step. A savvy investor knows that this number is not set in stone; it is a performance metric you can and should actively improve. This is where you move beyond theory and into proactive portfolio management, turning a good investment into a great one.

Ultimately, your strategy boils down to two core levers: boosting your income and controlling your costs. By focusing on both, you widen your profit margins and strengthen your asset’s performance, no matter where it is located in the world.

Drive Higher Income with Strategic Upgrades

One of the most direct ways to justify a higher rent and attract better-quality tenants is through cost-effective renovations. The key is to focus on upgrades that deliver a real return on investment, not just superficial changes.

Here are a few value-add improvements that work time and time again:

- Modernise Kitchens and Bathrooms: These two rooms hold the most sway over a tenant’s decision. Upgrading to modern fixtures, installing fresh countertops, or even professionally re-spraying tired cabinets can instantly command a higher rent.

- Enhance Kerb Appeal: First impressions are paramount. For a house or villa, simple actions like professional landscaping, a new front door, or modern outdoor lighting can make your property stand out in a competitive market.

- Incorporate Smart-Home Technology: Features like smart thermostats, keyless entry systems, and integrated security are no longer niche. They are increasingly expected by younger, more affluent tenants who are willing to pay a premium for added convenience.

“Investors often overlook the power of small, targeted upgrades,” says Nick Marr, founder of Homesgofast.com. “A modest investment in quality-of-life features can directly translate into a healthier yield and a lower vacancy rate, as premium tenants tend to stay longer.”

Optimise Management and Rental Strategy

How you manage the property is just as crucial as its physical condition. Efficient operations slash your expenses and minimise costly vacancy periods, giving your net yield a direct boost.

Another critical decision is your rental model. Do you opt for a traditional long-term tenancy or a short-term holiday let on a platform like Airbnb? Short-term lets can generate significantly higher income, especially in tourist hotspots, but they also demand more intensive management, higher running costs, and can face tighter regulations.

A long-term tenancy, on the other hand, offers more stable and predictable income with a much lower hands-on workload. Your choice here will have a massive impact on both your final yield and your lifestyle as an investor.

Common Rental Yield Mistakes to Avoid

Even the most seasoned investors can fall into predictable traps when evaluating a property’s potential. Knowing how to calculate rental yields is one thing; applying that knowledge with discipline is another game entirely. Dodging these common blunders is absolutely critical for protecting your capital and ensuring your investment performs as expected.

One of the most frequent mistakes is blindly trusting the gross yields advertised by property developers or selling agents. You must remember, those figures are marketing tools. They are designed to grab your attention by painting the most optimistic picture possible, conveniently omitting all the operating costs that will inevitably diminish your real return.

Overlooking Hidden and Ongoing Costs

It is surprisingly common for investors, especially those new to the international market, to completely underestimate the budget required for maintenance and repairs. A solid rule of thumb is to set aside 1% to 2% of the property’s value every single year just for upkeep.

For a €500,000 villa, that is a hefty €5,000 to €10,000 per year that must be factored into your net yield calculation. Ignoring this creates a dangerously inaccurate forecast that can jeopardise your investment.

Likewise, many investors fail to dig deep enough into service charges or homeowner association (HOA) fees, particularly in luxury apartment buildings or managed communities. These can be a real shock.

A prime example is an investor who purchased a high-yield apartment in a major city. The advertised 7% gross yield looked fantastic on paper. But after factoring in the steep annual service charges of €8,000 for the concierge, pool, and gym, the real net yield collapsed to under 4%. A painful lesson in due diligence.

Misjudging Vacancy Periods

Another critical error is assuming your property will be tenanted 100% of the time. In reality, that almost never happens. You will have tenant turnover, seasonal lulls in demand, and periods blocked out for refurbishments—all creating costly vacancies.

Any prudent financial model must include a buffer for this. A conservative, and much more realistic, approach is to budget for at least one month of vacancy per year. That works out to be roughly 8.3% of your potential annual rental income that you simply will not receive.

Failing to account for these void periods directly inflates your projected earnings and sets you up for major financial disappointment. You can learn more about what goes into a successful purchase by reading our guide on the 7 reasons you should buy a rental investment property.

Ultimately, a rigorous due diligence process is your best defence. Scrutinise every single cost, question every assumption, and build your financial models on conservative, real-world data—not aspirational marketing figures. That discipline is what separates a truly profitable international property portfolio from a collection of underperforming assets.

Common Questions from International Investors

Navigating the world of international property inevitably raises questions. Here are some of the most common queries we receive about rental yields and what those numbers really mean for your investment strategy.

What is a “Good” Rental Yield for an International Property?

A “good” rental yield is entirely dependent on the specific market. There is no single magic number.

In a stable, mature market like a major European capital, a net yield of 3-4% would be considered a solid achievement. However, if you are targeting higher-growth, higher-risk emerging markets in regions like South America or Southeast Asia, you should aim for a much higher return—often 7-10% or more. That additional margin is your compensation for taking on greater potential volatility. The key is to benchmark any prospective deal against local averages and the country’s specific risk profile.

How Does a Mortgage Affect My Yield Calculation?

This is an excellent question that often confuses new investors. Standard gross and net yield calculations intentionally exclude mortgage costs. This is because their purpose is to measure the property’s performance as a standalone asset, entirely separate from your financing decisions.

To understand the return on your personal cash investment, you need a different metric: the cash-on-cash return. This powerful formula compares your annual pre-tax cash flow (which is calculated after mortgage payments) to the total cash you invested in the deal (your deposit plus all closing costs).

Should I Use Monthly or Annual Figures to Calculate Yield?

Always, always use annual figures. It is the only way to achieve a reliable and accurate calculation.

Relying on a single month’s rent is incredibly misleading because it completely ignores the realities of property ownership. Consider these factors:

- Seasonality: Rents in holiday markets can fluctuate wildly from one month to the next.

- Vacancies: What about the empty month between tenants? A monthly calculation will not account for it.

- Large Bills: Expenses like insurance or property taxes are often paid in one lump sum annually.

To get an accurate picture, multiply your expected monthly rent by 12 and then sum all your projected annual expenses. It is the only method that provides a realistic view of how your investment is actually performing.

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers

https://homesgofast.com/sell-overseas-property/