The international real estate market is experiencing rapid transformation, with increasing numbers of foreign buyers seeking opportunities for investment, second homes, retirement, or relocation. International real estate listings offer critical insights into the latest market trends, pricing fluctuations, and the most attractive destinations for global investors.

Emerging Trends in International Real Estate

Foreign property investment is driven by various economic and lifestyle factors. Some key trends include:

- Golden Visa Programs – Countries like Portugal, Spain, and Greece provide residency to non-EU buyers who invest in real estate.

- The Rise of Remote Work – Destinations such as Mexico, Costa Rica, and Bali are popular among digital nomads seeking affordability and quality of life.

- Luxury Property Growth – Dubai, Monaco, and Miami continue to attract high-net-worth individuals looking for exclusive real estate.

- Sustainability & Green Investments – Countries like Canada, New Zealand, and Sweden are experiencing growing demand for eco-friendly properties.

Top Countries for Foreign Buyers

1. Portugal

Portugal remains a top choice for investors, particularly in Lisbon and Porto. Its Golden Visa program, stable property market, and high rental yields make it appealing to both European and American buyers. See

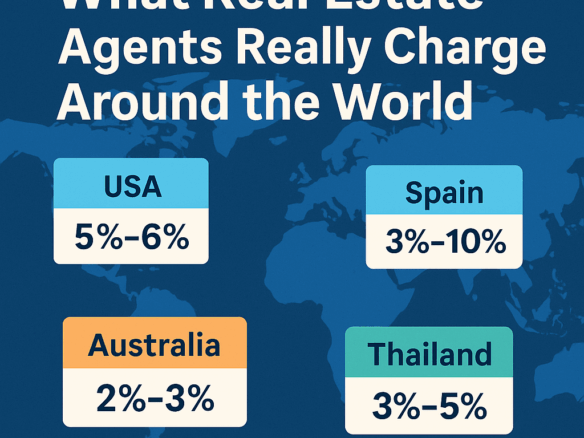

2. Spain

From Marbella’s luxury villas to Valencia’s affordable apartments, Spain’s diverse property market attracts UK and German buyers seeking second homes or investment properties.

3. United Arab Emirates

Dubai’s tax-free status, high rental yields, and continuous urban development make it a popular destination for investors worldwide.

4. United States

International buyers, particularly from China and Latin America, invest in the U.S. due to its economic stability. Key cities include New York, Miami, and Los Angeles.

5. Thailand

Cities like Bangkok, Phuket, and Chiang Mai remain hotspots for expatriates and retirees due to their affordability and high rental potential.

Where Are Buyers Investing?

Chinese Investors

Chinese buyers favor destinations that offer economic stability, educational opportunities, and strong market growth. Top investment locations include:

- United States – Cities like New York and Los Angeles are favored for their strong economies and top-tier universities.

- Australia – Sydney and Melbourne are attractive due to their quality of life and proximity to China.

- Canada – Vancouver and Toronto remain key hubs due to their stable housing markets and multicultural environments.

- United Kingdom – London continues to be a prime choice due to its financial significance. see latest London Investment Property

- Japan – Urban centers like Tokyo offer promising long-term investment potential.

(Source: Juwai)

Middle Eastern Investors

Middle Eastern investors typically seek luxury properties and strategic financial hubs. Popular destinations include:

- United Kingdom – London’s high-end real estate attracts many Middle Eastern buyers.

- France – The French Riviera is a hotspot for elite investors.

- United Arab Emirates – Dubai’s booming economy and tax incentives make it a premier investment choice.

- Turkey – Istanbul offers lucrative investment opportunities and cultural ties for Middle Eastern buyers. Buy Luxury Homes in Turkey

(Source: Barclays Private Bank)

Key Considerations for International Buyers

Before purchasing property abroad, foreign investors must evaluate:

✔ Residency & Visa Requirements – Some countries offer investment-based residency programs.

✔ Tax Implications – Property taxes, capital gains, and inheritance laws differ across markets.

✔ Currency Exchange Rates – Fluctuations can significantly impact real estate affordability.

✔ Local Market Conditions – Investors should analyze rental yields, demand trends, and potential appreciation.

Market Insights from Industry Reports

Industry experts and real estate analysts highlight global trends:

📊 “Real estate remains resilient with limited high-quality assets and stronger-than-expected markets.” – M&G Global Real Estate Outlook

🌍 “The global real estate market is projected to reach $654.39 trillion by 2025, with residential real estate valued at $534.37 trillion.” – Statista Report

🏡 “The European real estate market, particularly in Germany, Austria, and Switzerland, continues to attract investors despite economic stagnation.” – Drooms Real Estate Report

📈 “Real estate markets are entering a cyclical recovery phase, presenting lucrative opportunities for investors.” – CBRE Market Outlook

📖 “Emerging Trends in Real Estate: 2024 Global Outlook” offers a detailed forecast on market conditions worldwide. – PwC Real Estate Trends Report

Final Thoughts

The international real estate market presents a wealth of opportunities for buyers looking for investment, second homes, or retirement properties. By staying informed on market trends, visa regulations, and taxation policies, investors can make informed decisions in high-growth destinations.

For more insights, explore global property listings at EuropeanProperty.com.