Yes, you can absolutely still find cheap houses for sale in Puerto Rico, but it is not as simple as showing up and grabbing a bargain. The island has become a tale of two distinct markets for astute real estate investors.

While the glitzy coastal areas are seeing prices skyrocket, real deals are still out there for buyers who know where to look and are willing to venture beyond the usual tourist traps. For international property buyers and real estate agents alike, understanding this duality is key to unlocking significant value.

The Truth About Finding Cheap Houses in Puerto Rico

On one hand, you have the high-demand, luxury spots—think Dorado, Condado, and Palmas del Mar. Tax incentives like Act 60 have pulled in a flood of high-net-worth buyers from the mainland USA, creating fierce competition and pushing prices into the stratosphere. These areas are decidedly not in the “cheap” category anymore.

But on the other hand, huge parts of the island remain incredibly affordable, packed with overlooked opportunities. The trick is to adjust your definition of “affordable” for the current market and look beyond the flashy headlines. You have to understand the real economic and social currents shaping property values region by region to find genuinely cheap houses for sale.

Understanding the Price Surge

The market shift here has been massive. Puerto Rico saw one of the fastest home price surges of any U.S. territory. Home values shot up by an incredible 22% in the fourth quarter alone—the highest yearly gain the Federal Housing Finance Agency has recorded since it started tracking in 1995.

That momentum did not stop, rolling right into the first quarter with another 11.6% jump.

During that time, the median home sale price hit around $290,000, a 32% leap year-over-year. It sounds like a lot, but perspective is everything. You can dig into the specifics in this report from Realtor.com.

Let’s put those numbers in context.

Puerto Rico Property Price Snapshot (Median Values)

This table gives a clear picture of how Puerto Rico’s market stacks up against the mainland, even with the recent price hikes.

| Metric | Puerto Rico (Q1) | Mainland USA (Q1) | Key Takeaway for Investors |

|---|---|---|---|

| Median Home Price | ~$290,000 | ~$398,000 | Still significantly more affordable than the average U.S. market. |

| Year-Over-Year Growth | 32% | Varies (often single digits) | Indicates a high-momentum market with strong recent demand. |

| Investor Focus | Tax incentives (Act 60), lifestyle | Diverse (rental income, appreciation) | The drivers are different, creating unique opportunities in PR. |

So, while the island is not the undiscovered gem it once was, it still offers serious value compared to what you would find in most U.S. or European markets.

The Dual Market Reality

This wild price growth has carved out two separate realities for real estate here. The luxury coastal properties are hitting premium prices, but the rest of the island is a totally different story.

Here is what is driving that split:

- Post-Hurricane Rebuilding: Years after Hurricane Maria, the rebuilding effort is still shaping the market. You will find a mix of newly renovated homes right next to properties that need a ton of work, which creates a huge price range, especially in rural areas.

- Local vs. Foreign Buyer Demand: The market is pulled in two directions. Locals tend to focus on more traditional, inland communities, while foreign investors have historically flocked to beachfront and resort-style properties.

- Infrastructure and Amenities: How close a property is to San Juan, modern infrastructure, and luxury amenities makes a massive difference in its value. The further you get from those hubs, the lower the price tag.

“Puerto Rico presents a fascinating paradox for property investors. The high-end market is driven by global economic factors and tax incentives, while the broader market reflects local economic realities and opportunities for value-add investment. The secret to finding a bargain lies in understanding which market you are operating in.”

For a savvy buyer, this is not a problem—it is an opportunity. It means that if you are willing to explore away from the crowded and pricey coastal strips, you can find properties with incredible potential. Finding cheap houses for sale in Puerto Rico today is less about stumbling upon rock-bottom prices everywhere and more about strategically finding undervalued homes in areas poised for growth.

Understanding the Island’s Unique Market Dynamics

To find a genuinely cheap house in Puerto Rico, you need to look beyond the postcard-perfect beaches. It’s about digging into the economic forces that really shape property values here.

The market is not just about location, location, location. It’s a complex mix of global trends, local building realities, and government policies that create both serious challenges and incredible opportunities for savvy investors.

Put simply, scoring a bargain means seeing the pressures that others only see as problems. These are the undercurrents that tell you if a property is a true hidden gem or just cheap for a very good reason.

The Affordability Squeeze

One of the biggest things shaking up the market right now is the squeeze on housing affordability. This is not just a feeling; it’s a hard-and-fast trend. Rising home prices, tariffs on building materials, and climbing interest rates have created a perfect storm.

This storm makes it tougher for the average local family to buy a home, which in turn puts pressure on pricing across the board. For an investor, this is not bad news—it is market intelligence. It shows you the friction between construction costs and final sale prices, especially for new builds. This is exactly why older, existing homes that do not need a massive capital injection are becoming so attractive.

The numbers do not lie. Puerto Rico’s housing affordability has cratered as the average price of new homes shot up 18.4% to $367,716. Even existing homes have climbed 12.8% to $212,811.

This has pushed the housing affordability index down to a mere 53%, a long way from the 100% benchmark. What does that mean in the real world? The average family only has about half the income they need to get a standard mortgage.

Turning Market Headwinds into an Advantage

While those numbers might look grim at first glance, a seasoned investor reads them differently. The high cost of building new and the financial hurdles for local buyers actually create clear pockets of opportunity. It funnels demand toward specific types of properties and locations—which is precisely where you should be looking.

Here is how to turn these dynamics to your advantage:

- Hunt for Renovation Potential: New construction is expensive, making “fixer-uppers” gold. A property that is structurally sound but needs a cosmetic update can be a fantastic buy. The cost to modernise is almost always far less than the cost to build from scratch.

- Keep an Eye on Foreclosures and Distressed Sales: The affordability squeeze unfortunately means more distressed properties hit the market. You can pick these up at a serious discount, but be prepared for rigorous due diligence on things like title searches and outstanding liens.

- Find Areas on the Cusp of Growth: Look at municipalities right next to the current hotspots. As prime locations get overpriced, demand naturally spills over into neighbouring towns. Get in before the boom.

As Nick Marr, founder of Homesgofast.com, puts it, “The smartest international buyers see these challenges as signposts. They point you toward renovation projects or areas on the verge of a boom, where the true value isn’t reflected in the price tag… yet.”

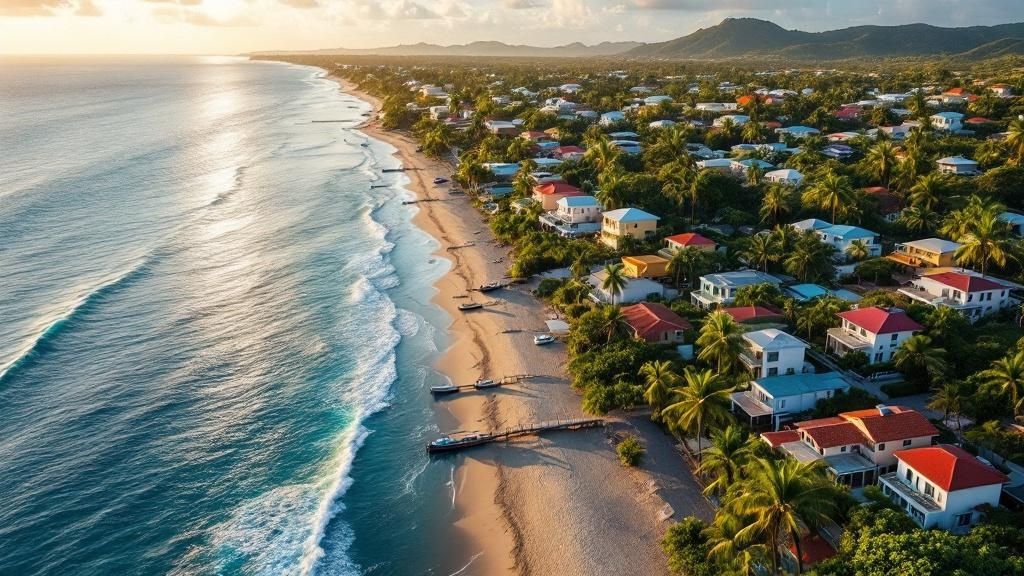

The Bigger Caribbean Picture

Understanding these local dynamics is powerful, but it’s even more so when you zoom out to the broader Caribbean region. The same forces affecting Puerto Rico—tourism, foreign investment, infrastructure—are part of a larger story playing out across the islands, from Panama to South American coastal nations.

By analysing trends across the Caribbean, you can get a better feel for market movements and spot which opportunities in Puerto Rico are truly special. To get more on this, check out our guide on why investors and homebuyers are increasingly looking to the Caribbean islands. This wider view helps put Puerto Rico’s unique value into context.

At the end of the day, navigating this market is about more than just finding a low price. It’s about understanding why a price is low and seeing the potential for growth that these economic pressures create. Take this analytical approach, and you will be able to sidestep the crowded, overpriced markets and lock down a truly valuable asset.

Where to Find Affordable Properties Beyond the Tourist Trail

If you are hunting for a genuine bargain, you have to look past the high-priced coastal spots that get all the attention. The real value—and a more authentic Puerto Rican lifestyle—is found where most tourists never go. This is your guide to uncovering those hidden gems where great deals are waiting.

Forget the inflated prices of Dorado and Condado. The true potential lies in the central mountains, along the authentic south coast, and in the laid-back towns of the west. Here, you will find everything from colonial fixer-uppers begging for restoration to sprawling rural fincas that offer total privacy.

The Central Mountains: Cordillera Central

Puerto Rico’s mountainous heart is a world away from the busy coast. Municipalities like Aibonito, nicknamed “The Garden of Puerto Rico,” and Utuado, a hub of ancient Taíno history, offer a cooler climate and a much slower pace of life.

Properties here are often single-family homes with land, perfect for anyone dreaming of a quiet retreat or a more self-sufficient lifestyle. The prices are significantly lower, but you should be ready for a more rustic way of living.

- Lifestyle: Expect a community-focused, agricultural vibe deeply connected to nature and local traditions.

- Property Types: You’ll mostly find concrete-built homes that need some modernisation, small farms, and land parcels for a fraction of what you would pay on the coast.

- Investment Angle: There’s great potential for eco-tourism ventures, coffee farm B&Bs, or simply as a long-term lifestyle investment.

The Southern Coast: Beyond Ponce

Ponce is the south’s cultural anchor, but the smaller towns around it are where you will find remarkable value. Check out municipalities like Guayama, with its charming historic town square, or Salinas, famous for its incredible seafood. These areas are far less saturated with foreign investors.

Here you can find delightful coastal towns without the premium price tag. For anyone interested in sea views, our overview of coastal property for sale offers a wider lens on what makes these southern Puerto Rican towns so unique.

The south coast delivers a unique blend of affordability and coastal living. It’s a market for buyers who prioritise authentic culture over resort amenities, offering a real chance to become part of the local community.

Properties often include traditional townhouses and modest beachfront homes that represent huge value compared to their northern counterparts. While we are focused on Puerto Rico, it helps to understand regional affordability. For context, see what a great deal on budget-friendly villas in the Dominican Republic looks like to appreciate the value here.

The Quieter West Coast

The west coast, especially the area north of the surfing hotspot Rincón, is packed with opportunity. Towns like Aguada and Moca are quieter, more residential alternatives to the tourist-heavy scenes in nearby Aguadilla and Rincón.

This region hits a sweet spot, offering easy access to beautiful beaches and amenities without the over-the-top prices. It’s an ideal location for someone seeking a relaxed beach lifestyle with solid investment potential as development gradually pushes northward.

Emerging Affordable Property Hotspots in Puerto Rico

To give you a clearer picture, here is a quick comparison of these off-the-beaten-path regions. This table breaks down what you can expect in terms of price, lifestyle, and investment outlook.

| Region / Municipality | Average Property Price Range | Primary Appeal | Investment Potential |

|---|---|---|---|

| Central (Aibonito, Utuado) | $80,000 – $180,000 | Cooler climate, large plots of land, authentic rural lifestyle. | Long-term appreciation, agricultural ventures, eco-tourism rentals. |

| South (Guayama, Salinas) | $100,000 – $250,000 | Historic charm, authentic coastal living, lower cost of living. | Strong rental potential for locals, slow but steady value growth. |

| West (Aguada, Moca) | $120,000 – $300,000 | Proximity to popular beaches, balanced lifestyle, growth potential. | Excellent short-term rental market, high appreciation potential. |

By stepping away from the well-trodden path, you are not just avoiding markets inflated by speculative money—you are stepping into areas driven by local economies. This move lowers your initial investment and connects you to a more genuine Puerto Rican experience, boosting the potential for both financial and personal rewards.

A Strategic Guide to Acquiring Property

Buying property in Puerto Rico is not like buying on the mainland or in Europe. It has its own rhythm, its own set of rules. If you are coming from abroad, you need a clear, actionable roadmap to get from that tempting online listing to holding the keys in your hand.

Your very first move? Get a local team on your side. This is not negotiable, especially when you are hunting for cheap houses for sale in Puerto Rico, as these often come with a complicated past. You will need a trusted, bilingual real estate agent, a sharp property lawyer (abogado), and a detail-obsessed inspector. They are your core support system.

Assembling Your Professional Team

Your agent is your boots on the ground, sniffing out properties that fit your goals. But it’s the lawyer who will truly protect you. They are indispensable for navigating the legal quirks unique to the island.

A good lawyer will immediately tackle two critical due diligence tasks:

- CRIM Verification: They will dive into the property tax records with the Centro de Recaudación de Ingresos Municipales (CRIM). The goal is to make sure there are no hidden debts. In Puerto Rico, unpaid property taxes can become a nasty surprise for the new owner.

- Title Search (Estudio de Título): This is probably the single most important step. The title search confirms the seller actually has the legal right to sell the place. It uncovers any liens, disputes, or other baggage attached to the property that could torpedo the deal.

Navigating Offers and Agreements

Found the right place? Initial checks look good? Now it is time to make an offer. Typically, you will submit a formal offer that, if accepted, leads to signing a purchase and sale agreement, known as the ‘contrato de compraventa’.

This is a legally binding contract. It lays out every detail—price, closing date, and any special conditions. Your lawyer’s job is to ensure this document protects you, including clauses that let you walk away if the inspection uncovers a deal-breaker.

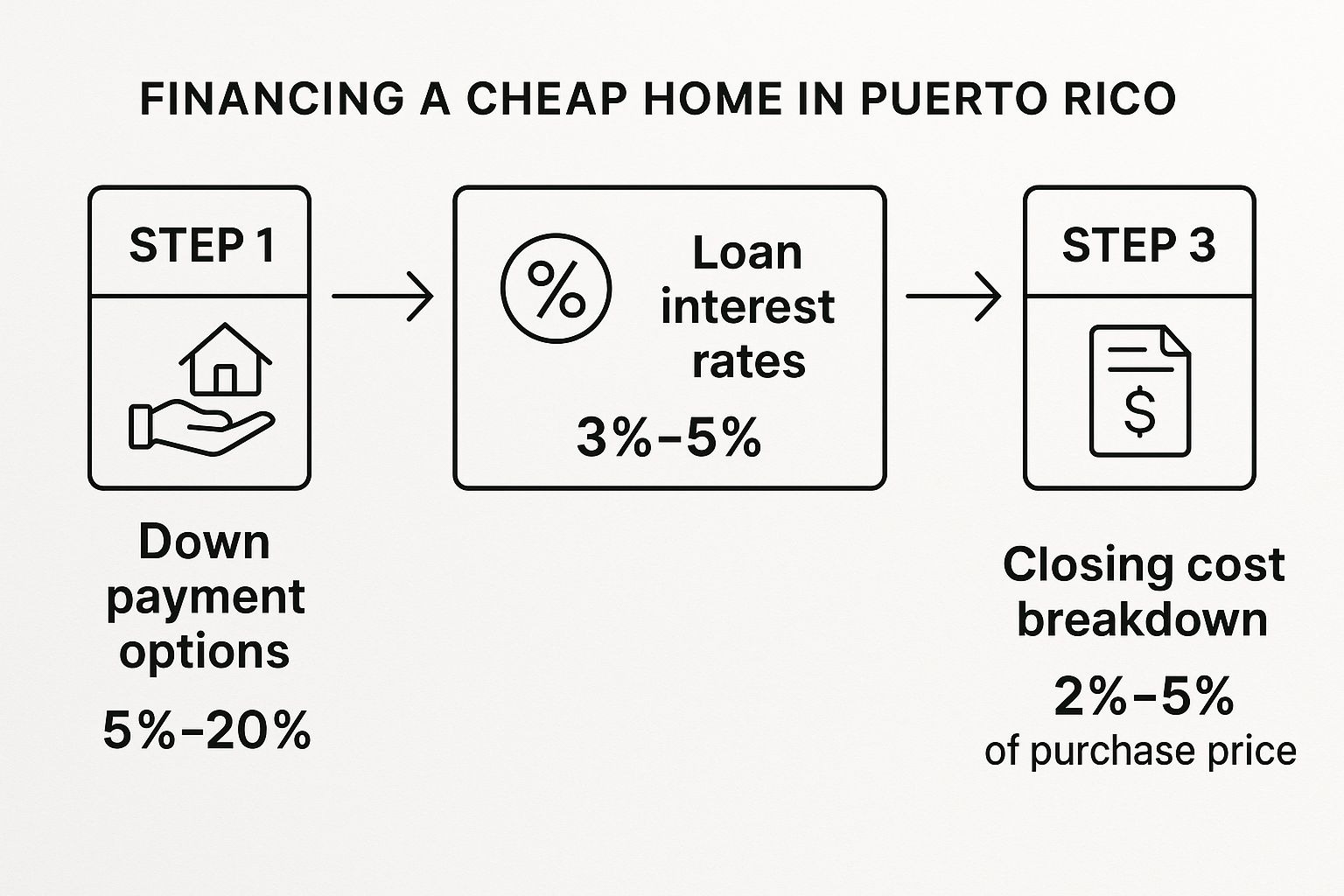

This gives you a snapshot of the basic finances involved in a property purchase on the island.

As you can see, financing a home here is pretty accessible. The down payments, interest rates, and closing costs generally fall within standard, reasonable ranges.

Due Diligence on Affordable Properties

Older, more affordable homes are where you find the real character—and the real potential for headaches. They demand a much deeper level of scrutiny.

A common trap for international buyers is underestimating unpermitted additions. I have seen it happen time and again. An owner adds a beautiful terrace or a whole new room without getting the proper permits. Years later, it becomes a massive legal and financial mess for the new buyer. A thorough inspection and legal verification are your only defence.

Drill down on these specific areas:

- Permit Verification: Have your lawyer confirm that every structure on the property—patios, extensions, even swimming pools—has the required government permits. Fixing this after the fact is a bureaucratic nightmare.

- Structural Integrity: For an older property, especially in a hurricane or seismic zone, do not just rely on a standard home inspection. Bring in a structural engineer. They are trained to spot signs of past damage that others might miss.

- Utility and Septic Systems: Headed to a more rural spot? Many homes rely on septic tanks and can have spotty utility services. You absolutely must confirm the condition and legality of these systems before you buy.

Financing for International Buyers

For U.S. citizens, getting a mortgage in Puerto Rico is pretty straightforward—it feels a lot like the process back on the mainland. Plenty of local banks and even major U.S. banks operate here.

But for buyers from Europe, South America and elsewhere, it can get a bit more complicated.

Financing is definitely available, but as a non-resident, you should be prepared to put down a larger down payment, usually somewhere between 20% and 30%. Lenders will want to see extensive paperwork, including proof of income, your credit history from back home, and detailed financial statements. A good tip is to start building a relationship with a local bank early on; it can really smooth out the bumps in the road.

For a more in-depth look, our guide on how to buy property overseas has some great insights that apply directly to the market here in Puerto Rico.

The Financial Landscape and Future Projections

A smart investment always has one eye on the future. To really get a feel for the long-term potential of buying a cheap house in Puerto Rico, you need to look past today’s prices and into what the market is doing tomorrow. It’s about understanding if you are snagging a temporary bargain or a truly sustainable asset.

The island’s property market is not just ticking along; it’s expanding with some real momentum. Let’s break down what that means for your investment.

Projecting Market Growth and Value

The numbers tell a pretty compelling story. Right now, Puerto Rico’s real estate market is valued at around $346.11 billion, with residential homes making up the bulk of that at about $265.54 billion.

But that is just a snapshot. The real news is the projected expansion—a compound annual growth rate (CAGR) of 3.01%. That is a healthy, steady pace that could push the market’s total value toward $389.68 billion. What’s fuelling this? A massive surge in median home sale prices, which have leaped by roughly 71%. This jump is a direct result of tight inventory meeting relentless demand from both locals and U.S. mainland buyers. You can get a closer look at the data behind these trends in some initial insights on Puerto Rico’s housing market forecasts.

This all points to one thing: the window for finding those truly incredible deals might be getting smaller. Acting strategically now is more important than ever.

The Interplay of Costs and Demand

What’s happening in Puerto Rico’s market is a classic case of supply and demand playing tug-of-war.

On one side, you have high construction costs, a hangover from supply chain hiccups and tariffs. This puts the brakes on new development, meaning fewer new houses are hitting the market.

On the other side, demand is absolutely red-hot, coming from two main camps:

- Local Buyers: A lot of Puerto Ricans are in the market for their first home, adding to the competition for affordable, existing properties.

- Mainland U.S. Investors: The island’s tax incentives and incredible lifestyle are a huge draw, pulling in buyers who are often looking for move-in-ready homes or vacation rentals.

This dynamic—limited new supply and strong, varied demand—is a powerful engine for driving up the value of existing homes. For an investor, it means that even a modest, affordable property you pick up today could see significant growth, simply because it’s becoming a scarcer resource.

Sustainability and Future Outlook

So, can this growth last? The signs are good, though things are starting to normalise. The explosive growth we saw right after the hurricanes is naturally settling into a more stable, upward trend—that 3.01% CAGR is a sign of a maturing market, not a bubble about to pop.

“The key to successful investment in Puerto Rico now lies in identifying properties where value is not solely tied to the luxury market’s performance. Focus on areas with strong local economies, improving infrastructure, and a clear path to growth. These are the assets that will deliver consistent returns long after the initial speculative frenzy has cooled.”

The long-term outlook remains bright. The island is continuously upgrading its infrastructure, the tourism sector is as resilient as ever, and its status as a U.S. territory provides a solid legal and financial foundation.

For anyone hunting for cheap houses for sale in Puerto Rico, the strategy is clear: find properties that will benefit from these core economic drivers. That way, you’re ensuring your investment’s appreciation is built on solid ground, not just a passing trend. It is the final piece of the puzzle that turns an affordable island home into a savvy financial move.

Frequently Asked Questions (FAQs)

Even the sharpest international investor has questions when they step into a new market. Puerto Rico is definitely no exception, with its unique mix of US legal systems and vibrant Caribbean culture. Let’s tackle some of the most common questions we get from buyers chasing those cheap houses for sale in Puerto Rico.

Think of this as your cheat sheet for navigating the final, crucial steps of your property journey.

Can I Get a Mortgage in Puerto Rico as a Non-Resident?

Yes, absolutely. For US citizens, the process will feel very familiar—it’s remarkably similar to getting a mortgage on the mainland. Plenty of local banks, and even major US ones, offer financing.

The main difference? Expect to bring more cash to the table. Lenders will typically ask for a higher down payment, usually somewhere between 20% to 30% of the home’s value. You will need to have all your financial ducks in a row: proof of income, assets, and a strong credit score.

If you are coming from Europe or another non-US country, the path can have a few more twists. My advice? Start building a relationship with a local bank early on. It’s a smart move that can make the whole application process much smoother.

For a deeper dive, our guide on international property mortgage advice is a great place to start.

Are Property Taxes High in Puerto Rico?

Good news on this front. Property taxes, which are handled by the Municipal Revenue Collection Center (known as CRIM), are generally much lower than in many US states. It is a huge plus for homeowners here.

Rates vary by town, but the real kicker is how they are calculated. Your tax bill is based on the property’s assessed value from way back in 1958, which is almost always a fraction of its current market price.

One crucial word of warning, though: always, always get a thorough title search to check for outstanding CRIM debts. This is a classic “gotcha” with older or distressed properties.

What Are the Main Risks with a Fixer-Upper Property?

Fixer-uppers are where you’ll find some of the absolute best deals on cheap houses for sale in Puerto Rico, but you have to go in with your eyes wide open. The risks boil down to two big things: the building’s physical state and its legal one.

- Structural Health: A lot of older homes hide secrets. We are talking damage from past hurricanes, sneaky termite infestations, or just decades of neglect. A professional, top-to-bottom structural inspection is not just a good idea—it is non-negotiable.

- Legal Status: You have to confirm that every room, every addition, every structure on that property is legally permitted. Unregistered construction can turn a dream bargain into a nightmare of fines and legal headaches.

Your best shield against these problems? A sharp, reputable local real estate attorney. Do not skip this step.

Do I Need to Speak Spanish to Buy Property?

While Spanish is the heart and soul of the island, English is widely spoken in professional circles—real estate, law, banking. You can absolutely get a deal done entirely in English without hitting any major roadblocks.

That said, having a bilingual agent and lawyer on your team is a massive advantage. It just makes everything easier, from negotiating with sellers to dealing with municipal offices, especially if you’re buying in a more rural area. Plus, trying your hand at a little Spanish goes a long way. It shows respect and is the best way to start building real connections in your new community.

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers? Go to

https://homesgofast.com/sell-overseas-property/