Thinking about a move to Switzerland? It’s a country that conjures images of pristine alpine lakes, clockwork efficiency, and a quality of life that’s second to none. For high-net-worth expats, it offers a compelling package: high salaries, rock-solid safety, and world-class infrastructure. But this dream comes with a reality check—a famously high cost of living and a reserved, orderly culture that can be a learning curve for newcomers. Living in Switzerland as an expat is a strategic move for those who prioritise stability and quality.

An Honest Look at Expat Life in Switzerland

Imagine a society where quality, security, and efficiency aren’t just buzzwords; they’re the foundation of daily life. That’s the Swiss experience in a nutshell. It’s no accident that Switzerland consistently tops global rankings for the best places to live. This reputation draws in talent from around the world, making cities like Zurich, Geneva, and Zug true multicultural hubs powered by a famously stable economy.

For international property buyers, Switzerland is more than just a place to live—it’s a safe haven. The country’s political and economic predictability, anchored by the strong Swiss Franc, makes its real estate market a fortress for wealth preservation.

Nick Marr, founder of Homesgofast.com and EuropeanProperty.com, puts it this way: “While the initial costs in Switzerland can seem high, investors quickly recognise that the stability, safety, and exceptional quality of life represent a significant return on investment that few other countries can match.”

This unique environment fosters a lifestyle that’s hard to beat. It’s a place where high-powered professional opportunities are balanced with an incredible work-life balance. Weekends here are often spent hiking jaw-dropping Alpine trails or skiing down world-famous slopes.

Before diving deeper, let’s weigh the good against the challenging. Here’s a quick snapshot of what you can expect.

Expat Life in Switzerland At a Glance

| Aspect | Pros (The Appeal) | Cons (The Challenges) |

|---|---|---|

| Economy & Career | High average salaries, low unemployment, and a stable currency. A global hub for finance, pharma, and tech. | Extremely competitive job market. High taxes and mandatory social security contributions. |

| Cost of Living | Salaries are structured to offset costs. High-quality goods and services are standard. | Among the highest in the world. Rent, groceries, dining, and healthcare are notoriously expensive. |

| Lifestyle & Leisure | Unbeatable access to nature—skiing, hiking, and lakes. Excellent work-life balance is culturally ingrained. | Many shops and services close on Sundays. Spontaneity can be less common in social planning. |

| Culture & Society | Punctual, orderly, and highly respectful society. Safe, clean, and family-friendly environment. | Can feel reserved and formal. Making close friends with locals can take time and effort. |

| Infrastructure | World-class public transport, healthcare, and education systems. Everything runs on time. | Strict rules and regulations govern everything from recycling to noise levels. |

This table highlights the core trade-offs. The very things that make Switzerland so orderly and prosperous—its rules and high standards—are also what can make it challenging to adapt to.

The Multicultural Fabric of Swiss Society

Switzerland’s reputation as a global hub isn’t just about banking—it’s woven into its demographics. The country has a long history of welcoming foreign talent, creating a genuinely cosmopolitan society.

As of late 2023, foreign nationals made up roughly 27% of the total 8.9 million population. That’s around 2.3 million foreign residents who are an integral part of the Swiss cultural and economic landscape. This figure has shot up from just 10% a century ago, with growth really taking off after 2002 when Switzerland signed the Free Movement of Persons agreement with the EU. To get a better sense of this, you can explore more detailed Swiss demographic data and its impact on the workforce.

Balancing the Dream with Reality

So, what’s the catch? The Swiss dream has its practical challenges. First and foremost is the cost of living—it’s undeniably steep. Everything from your monthly rent and grocery bill to a casual dinner out is among the most expensive in the world.

Adapting to the culture also requires a bit of patience. The Swiss place a high value on punctuality, privacy, and following the rules, which can feel a little rigid if you’re not used to it. Building deep friendships can take time, as locals tend to be polite and professional but initially reserved. Getting a handle on this balance between the immense perks and the day-to-day realities is your first step to a successful life in Switzerland.

Securing Your Swiss Visa and Residency Permit

Let’s be honest, navigating the Swiss immigration system can feel a little intimidating at first. But like most things in Switzerland, it runs on logic and precision. Once you understand the basic framework, the path forward becomes much clearer.

The most important thing to know is that the process is completely different depending on your passport. There’s one route for citizens of the European Union (EU) or European Free Trade Association (EFTA) countries, and another, more demanding route for everyone else (often called third-country nationals).

For professionals and high-net-worth individuals, it helps to think of this as building a business case for yourself. Your qualifications, your financial standing, and your reasons for moving are the key ingredients for a successful application. This is a crucial step for anyone planning on living in Switzerland as an expat long-term.

The Path for EU and EFTA Citizens

If you hold a passport from an EU/EFTA member state, you’re in luck. Thanks to the Agreement on the Free Movement of Persons, the process is significantly streamlined. As long as you have a valid job contract or can prove you have enough money to support yourself, getting a residence permit is pretty straightforward.

You’ll generally come across three main types of permits:

- Permit L (Short-Term Residence): This is for work contracts that last less than one year. It’s directly tied to the length of your job.

- Permit B (Initial or Temporary Residence): The standard permit for those with a job contract of one year or more, or for self-sufficient individuals. It’s usually valid for five years and can be renewed.

- Permit C (Settlement Permit): This is the Swiss equivalent of permanent residency. EU/EFTA citizens can usually apply for a C permit after living in Switzerland continuously for five years.

The crucial step for EU/EFTA nationals is registering with your local cantonal office within 14 days of arriving—and you must do this before you start working. You’ll need to bring your passport, proof of your Swiss address, and your employment contract.

Requirements for Non-EU and EFTA Nationals

For anyone from outside the EU/EFTA zone (including Americans, Brits, and Canadians), the journey is much tougher. The Swiss government sets strict annual quotas, making residency highly competitive. The golden rule here is that you absolutely need a confirmed job offer before you can even think about applying for a visa.

Your future employer has to jump through quite a few hoops. They must prove to the authorities that they couldn’t find a suitable candidate from anywhere within Switzerland or the entire EU/EFTA bloc.

This means your application gets put under a microscope, and they’ll be looking at:

- Professional Qualifications: You almost always need to be a highly qualified professional, which usually means a university degree and solid professional experience.

- Economic Need: The job you’re taking must be seen as beneficial to the Swiss economy.

- Integration Potential: Factors like your age and your ability to speak one of Switzerland’s national languages can also play a role.

Your employer is the one who has to manage the approval process with both cantonal and federal authorities. Only after they get the green light for your work authorisation can you apply for a long-stay (Visa D) at the Swiss embassy in your home country.

It’s also a good idea for non-EU travellers to stay on top of the latest entry rules. You can learn more by reading about the new travel rules to Europe for what non-EU travellers must know.

Once you arrive, you’ll be issued a biometric residence permit. This is usually a Permit B, which is tied to your specific employer and typically needs renewing every year. Getting to the coveted Permit C as a non-EU national is a long game—it usually takes ten years of continuous residence. However, for those who show exceptional integration into Swiss life, this can sometimes be fast-tracked to five years.

Breaking Down the Swiss Cost of living

Let’s get straight to the point: Switzerland is expensive. There’s no sugarcoating it. But for seasoned professionals and high-net-worth individuals, the high cost of living isn’t a bug; it’s a feature—a reflection of the incredible quality, stability, and safety the country delivers.

The real key to understanding Swiss finances is to stop looking at costs in a vacuum. A CHF 5 coffee or a CHF 3,000 monthly rent in Zurich seems steep until you realise Swiss salaries are among the highest in the world. This creates a powerful level of purchasing power that often catches newcomers by surprise.

Think of it this way: the premium you pay for daily life is your ticket to pristine environments, world-class public services, and unparalleled peace of mind. That’s the balance that makes Switzerland a top-tier destination.

Housing: The Cornerstone of Your Budget

For nearly every expat, housing will be the single largest line item in your monthly budget. The rental market is notoriously competitive, especially in economic powerhouses like Zurich and Geneva where demand consistently outstrips supply. The cost of renting or buying a luxury home in Switzerland is a significant consideration.

In Zurich, a standard two-bedroom apartment in a good neighbourhood will set you back anywhere from CHF 3,000 to CHF 5,000. Geneva is right there with it, commanding similar prices for desirable properties. Even in the more relaxed capital of Bern, you should still budget around CHF 2,500 for a similar flat.

This perspective is crucial. Those high rental figures aren’t arbitrary; they reflect the immense value and desirability of Swiss real estate, a foundation of the nation’s economic strength.

Mandatory Health Insurance: A Non-Negotiable Cost

Here’s something you need to know right away: health insurance in Switzerland is mandatory for every resident. Unlike in many countries, it’s not run by the state but managed through a system of private insurers. You have exactly three months from your arrival to get a policy in place.

Premiums for the basic mandatory coverage (KVG/LAMal) for a single adult usually fall between CHF 300 and CHF 500 per month. The exact amount depends on your canton, the insurance provider, and the deductible (franchise) you select—a higher deductible means a lower monthly premium.

This is a fixed cost you must factor into your monthly outgoings. It’s not cheap, but the trade-off is access to a healthcare system that is consistently ranked among the best in the world for its quality and efficiency.

Daily Expenses: Groceries, Transport, and Leisure

Beyond the big-ticket items, your day-to-day spending habits will really define your budget. Supermarkets like Coop and Migros are known for their high-quality products, but you’ll notice the prices are a notch above those in neighbouring European countries. A single person should probably budget around CHF 600–800 a month for groceries.

Public transport is so good here it’s legendary. It’s clean, punctual, and extensive, making a car totally unnecessary in the major cities. A monthly travel pass for a city like Zurich costs about CHF 85 for unlimited rides.

Leisure and entertainment also carry a premium. A dinner for two at a decent mid-range restaurant can easily run CHF 120–150, and things like movie tickets or a gym membership will also be higher than the European average.

Of course, to really plan your budget, you need to know what you’ll be earning. Properly conducting market salary research is just as important as tracking expenses.

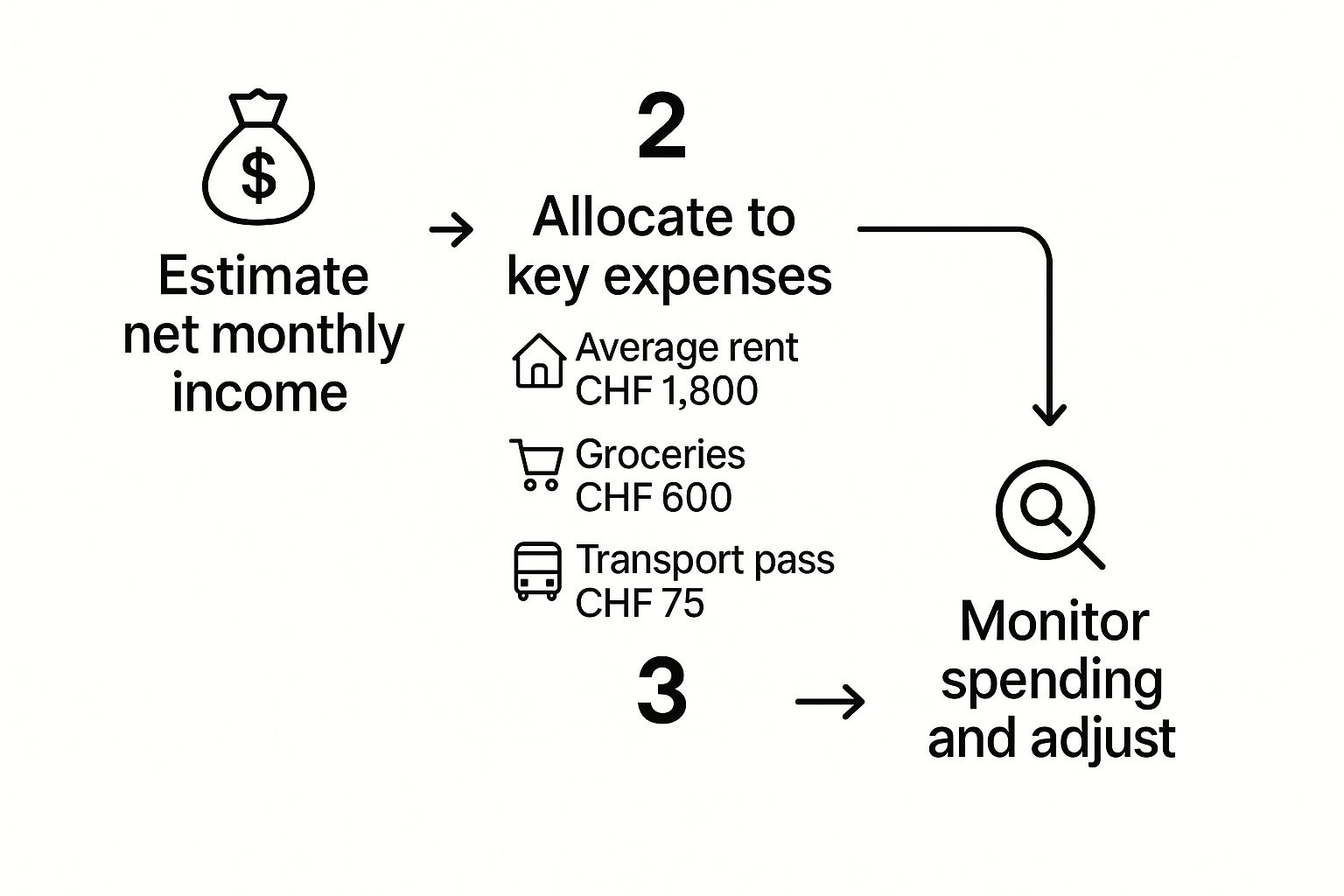

To give you a clearer picture, here’s a breakdown of what you might expect to spend each month in a few major cities.

Average Monthly Living Expenses in Major Swiss Cities (CHF)

The table below offers a snapshot of estimated monthly costs for both a single person and a family of four. These are, of course, estimates—your own lifestyle and choices will make a big difference.

| Expense Category | Zurich (Single Person) | Zurich (Family of 4) | Geneva (Single Person) | Geneva (Family of 4) |

|---|---|---|---|---|

| Rent (2-Bed Apt) | 3,500 | 5,500 | 3,400 | 5,800 |

| Health Insurance | 400 | 1,400 | 450 | 1,600 |

| Groceries | 700 | 1,500 | 750 | 1,600 |

| Transport Pass | 85 | 170 | 70 | 140 |

| Utilities | 200 | 350 | 220 | 380 |

| Total Est. Costs | 4,885 | 8,920 | 4,890 | 9,520 |

While the numbers might look intimidating at first glance, it’s the whole package that matters. When you pair these costs with the high salaries and exceptional quality of life, the financial picture for an expat living in Switzerland becomes very compelling.

Navigating the Swiss Property Market

Finding a place to call home is a huge step when living in Switzerland as an expat, and you’ll find the market is known for its high standards and fierce competition. Whether you plan to rent or buy, you need a solid strategy. The whole process is precise and rule-based—much like Swiss culture itself—and it definitely rewards those who come prepared.

Most expats, at least in the beginning, dive into the rental market. Be warned: competition for good apartments in hotspots like Zurich and Geneva is intense. It’s not uncommon for landlords to get dozens of applications for a single property, so success often comes down to who has the most flawless application.

Check out latest luxury homes for sale in Switzerland

The Rental Process: A Strategic Approach

Securing a rental here is about more than just finding a listing online. You need to put together a comprehensive application package, or dossier, that makes a landlord or agency feel confident you’re the ideal, reliable tenant they’ve been looking for.

This dossier almost always includes:

- A completed application form: Usually provided by the real estate agency.

- Proof of employment and salary: Your work contract or recent pay slips will do the trick.

- A copy of your residence permit: This shows you have the legal right to live in Switzerland.

- An extract from the debt collection register (Betreibungsauszug): This is a critical document proving you have no outstanding debts. You can get this from the local debt enforcement office (Betreibungsamt).

Once your application gets the green light, get ready for the financial side. It’s standard practice to pay a security deposit equal to three months’ rent. This isn’t just handed over; it’s held in a special blocked bank account in your name. On top of that, most landlords will require you to have personal liability insurance (Haftpflichtversicherung) before they’ll even think about handing over the keys.

Understanding the Rules of Property Ownership

For those looking to put down more permanent roots, buying property in Switzerland is a compelling but complex option. The Swiss real estate market is one of the most stable in the world, which naturally makes it a prime target for international investors. Because of this, the government has strict regulations in place to stop foreigners from speculative buying.

The key piece of legislation here is the Lex Koller law. This federal act seriously restricts non-resident foreign nationals from purchasing residential property. In simple terms, if you don’t live in Switzerland, your chances of buying a home are incredibly slim.

“Switzerland’s property laws are designed to protect market stability and prioritise residents. For investors, this isn’t a barrier but a feature, ensuring that the market remains robust and avoids speculative bubbles seen elsewhere. It’s a system that rewards commitment to the country.” – Nick Marr, Founder of Homesgofast.com.

Your residency status is the key that unlocks the door. As a foreign national holding a valid Swiss B Permit (your initial residence permit), you are generally allowed to purchase a primary residence for you and your family to live in. This is a huge milestone for any expat, allowing you to invest in a tangible asset within one of the world’s most secure economies.

It’s also worth noting that rules can differ from one canton to another. Some regions have more liberal policies, especially in designated tourist zones where foreigners might be allowed to buy holiday homes under specific conditions. For example, understanding the local nuances is critical if you’re eyeing a spot in the Alps. For a closer look, our guide on what you need to know about buying property in Verbier offers detailed insights into one of these prime markets.

At the end of the day, whether you’re renting or buying, tackling the Swiss property market demands diligence, preparation, and a solid grasp of the rules. With the right permit and a well-organized approach, finding your home here becomes a manageable—and very rewarding—part of the expat journey.

Getting Set Up: The Essentials for Swiss Life

Once you’ve landed, a few key administrative tasks will make your transition into living in Switzerland as an expat feel much smoother. Think of these as the three pillars of your new life: getting your health insurance sorted, opening a bank account, and figuring out schools for the kids.

Nailing these early on saves you from a world of bureaucratic headaches down the line. It builds a solid foundation, letting you get on with the fun part of exploring your new home.

Securing Mandatory Swiss Health Insurance

First things first: in Switzerland, top-notch healthcare isn’t just a perk; it’s a legal requirement. Every single resident must have a basic health insurance plan, known as LAMal/KVG. There are no exceptions here.

You get a strict three-month deadline from your official arrival date to get yourself signed up with an insurance provider. Don’t let this slip. If you miss the window, the canton will assign you a provider, and it’s almost always a more expensive one.

The system is run by private companies, which means you have the power to shop around. When you’re comparing plans, you’ll be juggling a few key factors that set your monthly premium:

- The Insurer: You’ll find over 50 companies offering the same government-mandated basic coverage. The surprise? Their prices can be wildly different.

- Your Deductible (Franchise): This is the amount you agree to pay out-of-pocket each year before your insurance starts covering the bills. Picking a higher deductible (up to a maximum of CHF 2,500) will lower your monthly payment.

- Your Insurance Model: You can save money with models like an HMO or a Telmed plan (where you call a hotline first), but they usually require you to see a specific doctor or get a referral.

Take your time and compare a few quotes. Once you’re in, you’ll have peace of mind knowing you’re covered by one of the best healthcare systems in the world.

Opening a Swiss Bank Account

For anyone working or living in Switzerland, a local bank account is non-negotiable. It’s how you’ll get paid, pay your rent, and manage daily life. Plus, in a country famous for its financial sector, it’s a key step to feeling properly settled.

The good news is that the process is incredibly straightforward for anyone with the right residence permit. Big names like UBS and Credit Suisse, along with the various cantonal banks, have this down to a fine art for expats.

To get your account open, you’ll generally need to show up with a small stack of documents:

- A valid passport or national ID card.

- Your Swiss residence permit (a B Permit is the standard).

- Proof of your address, like a rental contract.

- They might also ask for proof of employment, like your work contract.

Getting this simple piece of admin ticked off is a huge step toward managing your finances like a local.

Choosing the Right School for Your Children

If you’re moving with family, schools are probably at the top of your mind. Switzerland has a fantastic dual system, offering world-class public schools alongside a network of prestigious private and international ones.

The public school system is run by the cantons, is completely free, and has an excellent reputation. The language of instruction is whatever is spoken locally (German, French, or Italian), which is an incredible way for kids to integrate, become fluent, and make local friends. This is a brilliant option, especially if you plan on staying long-term.

On the other hand, you have international schools, which are tailored for the expat community. These schools typically follow curricula like the International Baccalaureate (IB) or the American/British systems, with English being the main language. They offer a familiar environment and a global community but come with hefty price tags, often ranging from CHF 25,000 to CHF 40,000 per child, per year.

Ultimately, the choice comes down to how long you plan to stay, your budget, and what you want for your children’s educational path.

Adapting to Swiss Culture and Etiquette

To truly thrive while living in Switzerland as an expat, you need to do more than just get your paperwork and bank account sorted. You have to get a feel for the local culture. Swiss society really runs on three core values: precision, privacy, and politeness. These aren’t just buzzwords; they genuinely shape daily life.

Your success here, both professionally and socially, will often depend on how well you adapt. Punctuality, for instance, is a big deal. It’s not just a suggestion—it’s a sign of respect. Showing up even a few minutes late for a meeting or a dinner invitation can be seen as a serious faux pas.

Understanding Social Norms

Communication in Switzerland is typically direct, yet always courteous. People value honesty and clarity, so conversations get straight to the point. For expats coming from more indirect cultures, this can sometimes feel a bit abrupt, but it’s rarely meant to be rude.

Privacy is another cornerstone of Swiss life. Don’t be surprised if people avoid personal questions about salary, family, or politics until you’ve known them for a while. This natural reserve means building deep friendships can take time, but patience and genuine effort are always rewarded.

Navigating Regional Differences

Switzerland is a fascinating mosaic of distinct cultural regions. The most famous divide is the ‘Röstigraben’, the line separating the German-speaking and French-speaking areas. This isn’t just about language; it reflects different social norms, business cultures, and even a different pace of life.

- German-speaking Switzerland (Zurich, Bern): Tends to feel more formal, structured, and direct.

- French-speaking Switzerland (Geneva, Lausanne): Often has a more relaxed, almost Mediterranean vibe, with a bigger emphasis on social lunches and networking.

- Italian-speaking Switzerland (Lugano): Beautifully combines Swiss efficiency with Italian warmth and flair.

Getting a handle on these nuances is key to feeling at home, whether you’re in the boardroom or at a local café. And probably the single best thing you can do? Make an effort to learn the local language, even if it’s just a few basic phrases. Exploring the seven things you should know when moving to a new country can offer some great universal tips for this journey.

Building Your Social Network

A fantastic way to meet people is by joining a local club, or ‘Verein’. This is a classic Swiss tradition and a highly effective way to connect with locals who share your interests, whether it’s hiking, skiing, music, or photography. It’s an authentic window into the community.

Switzerland’s population is set to grow from 9.0 million in 2024 to 10.5 million by 2055, an increase of 16.7% that’s largely driven by immigration. This shift underscores the vital role expats play in the country’s society and economy, especially around Zurich and Geneva. As an expat, you’re not just a temporary guest; you’re becoming a part of this evolving social fabric.

Frequently Asked Questions About Moving to Switzerland

Moving to a new country always kicks up a storm of questions, big and small. Once you get past the major hurdles like visas and finding a place to live, the practical day-to-day queries start to surface.

To help you get straight answers, we’ve put together a quick guide to some of the most common questions we hear from people planning on living in Switzerland as an expat.

Can I Buy Property in Switzerland as a Foreigner?

Yes, but it’s not a free-for-all. The rules are quite specific. If you’re an official resident with a valid B permit, you can generally buy a primary home for yourself without needing special permission.

Things get tricky for non-residents or those without the right permit. Switzerland’s ‘Lex Koller’ law heavily restricts foreigners from snapping up residential property purely for investment. Buying holiday homes is also tightly controlled and usually limited to designated tourist areas defined by each canton.

What Are the Main Taxes I Need to Be Aware Of?

Get ready for a multi-layered system. In Switzerland, you pay taxes at three different levels: federal, cantonal (state), and municipal (local). It’s a core part of how the country runs.

The big ones to know are:

- Income tax on your earnings.

- Wealth tax on your total net assets.

- Value-added tax (VAT) on goods and services you buy.

Your final tax bill can vary dramatically depending on your canton and municipality. It’s one of the biggest reasons why your choice of where to live is such a crucial financial decision.

Is It Possible to Live in Switzerland Without Speaking a National Language?

In the big international hubs like Zurich, Geneva, and Zug, you can definitely get by with just English. These cities have massive expat communities, and English is the language of business.

But if you want to truly integrate, you’ll need to learn the local language. Simple things like dealing with the local authorities or even just making small talk at the bakery become much easier. Picking up some basic German, French, or Italian (depending on your region) will open doors and help you move beyond the “expat bubble.”

Ready to explore the stability and value of the Swiss property market? At HomesGoFast.com, we connect buyers from around the world with premium real estate in Switzerland’s most sought-after locations. Start your search for the perfect Swiss home today.

Find your ideal property in Switzerland on HomesGoFast.com

About Homesgofast.com

HomesGoFast.com is a leading international property website, established in 2002, helping homeowners, real estate agents, and developers reach overseas buyers. Featuring thousands of listings from over 50 countries, the platform connects global property seekers with homes, apartments, villas, and investment opportunities worldwide.

Looking for expert mortgage guidance? Get international property mortgage advice here:

👉 https://homesgofast.com/mortgages-overseas/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/

Looking to sell real estate to foreign buyers

https://homesgofast.com/sell-overseas-property/