Opinions are subjective, but the numbers don’t lie. Despite the warnings and admonitions you may hear from people who were burned by the 2008 Housing Crisis, taking a look at the cold, hard figures would suggest that now is the perfect time to invest in real estate. They aren’t making more land, and the rat race to acquire available property is in full swing. Stop second guessing yourself and pull the trigger now. Here’s why:

· Rates are going up

The Federal Reserve recently bumped up the record-breaking low interest rate from 3% to 4% for a 30-year mortgage. Considering the momentum of economic growth, we’re expected to see two or more spikes throughout the year, with 5% rates anticipated by the end of the year. If you’re the type of person who’d like to take advantage of low real estate interest rates, now might be the time to buy a home.

· Prices are steadily climbing

According to the Case-Shiller index—which measures home appreciation using data that goes back to 1890—home prices have risen roughly 5% to 6% in the past few years. This incline has been steady since the market crash in 2008, and economists predict the trend will continue in 2018 and beyond.

What does this mean for you? If you’re waiting to cash in on a sudden drop in housing costs, you could be making a big mistake. Of course no one can predict the future, but pricing appears to be on a steady upward climb.

· Inventory is increasing

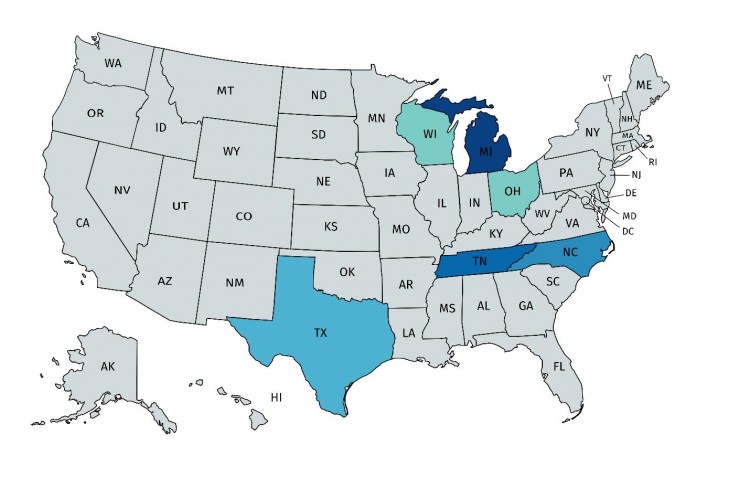

An inventory shortage has plagued the United States since 2015, but markets are expected to recover by fall of 2018. A recent survey conducted by Trulia projects the strongest growth in the following cities:

o Grand Rapids, Mich.

o Nashville, Tenn.

o Raleigh, N.C.

Now is the right time to invest in real estate in these regions, specifically the Midwest and South, based on Trulia’s five key metrics:

1. Strong job growth over the past year (as a sign of economic prosperity and opportunity)

2. Low vacancy rates (as a measure that housing supply does not exceed demand)

3. High starter-home affordability (as a market indicator that first-time buyers have a chance to buy)

4. More inbound home searches than outbound (as a gauge of market popularity)

5. Large share of adult population under age 35 (as a signal of growing home buying population amongst young people)

Based on these indicators, keep your eye open for increased opportunities to invest in real estate.

*Darkest blue indicates best places to buy based on Trulia’s data

· Financing is available

If you can’t afford to invest in real estate outright, financing is readily available—especially for those in the fix and flip business. Some buyers prefer not to enter into mortgages which span decades—especially as interest rates are on the rise—and instead opt for hard money loans. Sometimes known as bridge or private loans, this financing is easy to come by and usually includes a fixed mortgage rate. Renovators in the desert can seek out Arizona’s Surprise hard money lenders, while developers in California can find bridge loans up and down the coast.

· Taxes can work in your favor

Taxes are inevitably complex, and the new 2017 Tax Cuts and Jobs Act (TCJA) is no exception. On the one hand, it introduces new limitations on deductions for mortgage interest payments and reduces incentives for homeownership. On the flip side, if fewer people are motivated to buy, it leaves plenty of room for competition.

Additionally, the National Association of Realtors and the National Association of House Builders lobbied against the increased standard deduction proposed by TCJA, fearing it would incentivize fewer people to claim the lower mortgage interest deduction. To accommodate, the cost of housing might lower slightly, which could work in your favor.

Finally, the reduced income tax puts more money in taxpayers’ pockets. That added disposable income can help those who wish to stop spending money on expensive rent and start building equity in home.

In sum, the real estate market looks healthy in 2018. Home ownership rates are expected to rise—and you could be part of that.